It Ain't Easy Being Macro

Random Roger's Retirement Planning

MAY 10, 2024

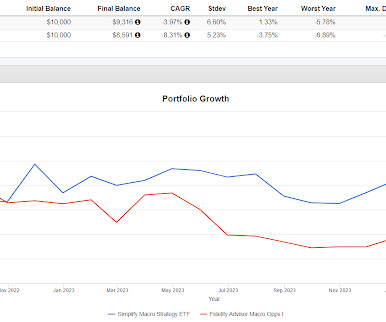

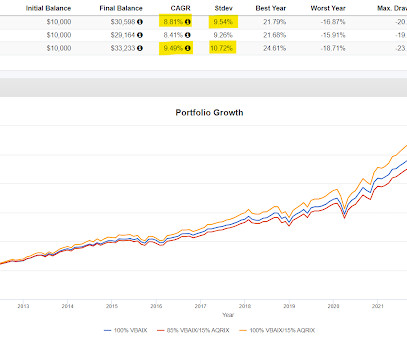

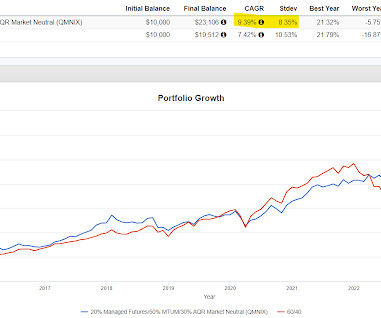

An investor needing something close to equity market returns for their financial plan to work needs something of a "normal" allocation to equities. Not that 20% is universally wrong, not everyone needs close to equity market returns for their financial plan to work. Macro strategies can be very complicated.

Let's personalize your content