1st Quarter 2024 Economic And Market Outlook: Potential Increased Volatility, Threats To Economic Growth, And Equity Markets

Nerd's Eye View

APRIL 3, 2024

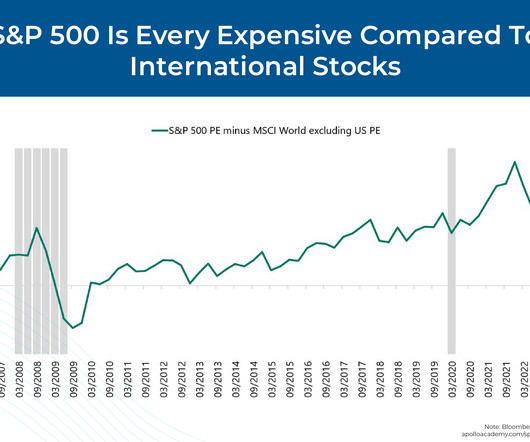

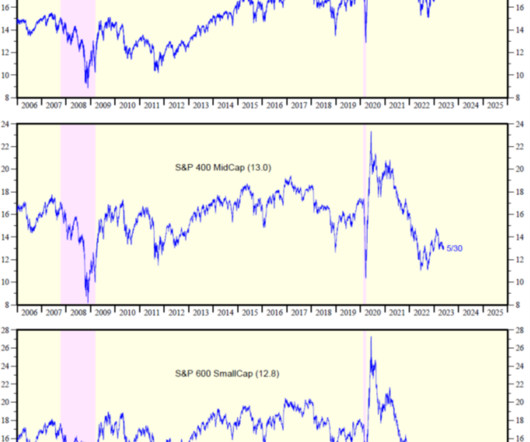

With a plethora of interdependent and ever-changing parts, gaining a clear (or even not-terribly-fuzzy) understanding of where the economy stands at any given moment is a daunting task, to say the least. At the same time, value and international stocks continue to lag, trading as if the economy is already in the depths of a serious recession.

Let's personalize your content