Research links: persistent investment factors

Abnormal Returns

DECEMBER 19, 2023

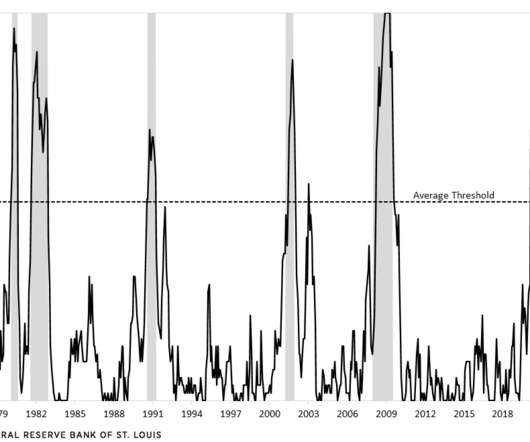

alphaarchitect.com) The high quality anomaly shows up across asset classes. advisorperspectives.com) A history of quant investing and the state of the factor zoo. on.ft.com) Corporate finance Stock-based compensation makes a big difference for company valuations. quantpedia.com) Retail attention is a mixed blessing for stocks.

Let's personalize your content