Client Letter | Outlook 2023: Finding Balance | December 6, 2022

James Hendries

DECEMBER 12, 2022

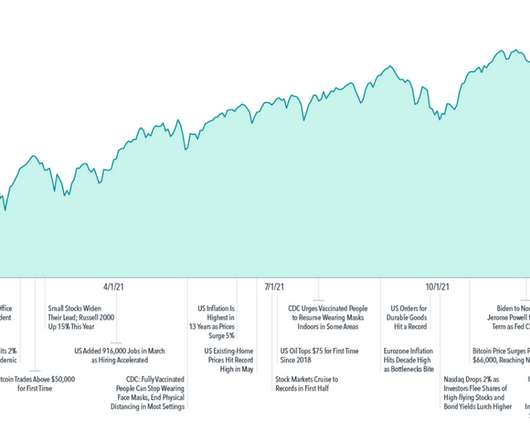

Whether it’s about the markets and global economy or what’s happening in our local communities, the news we’re hearing on a daily basis has the potential to disrupt the balance of our lives. LPL Research’s Outlook 2023: Finding Balance is our guide to how the readjustments in the economy and markets may impact you in the coming year.

Let's personalize your content