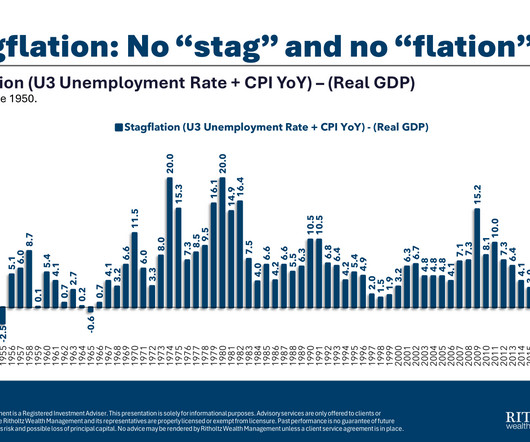

What Stagflation?

The Big Picture

MAY 16, 2024

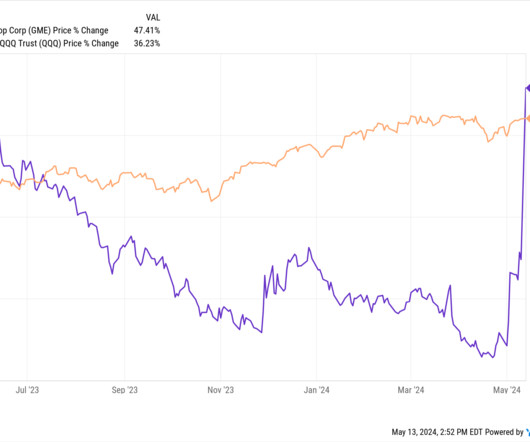

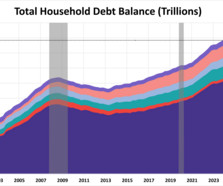

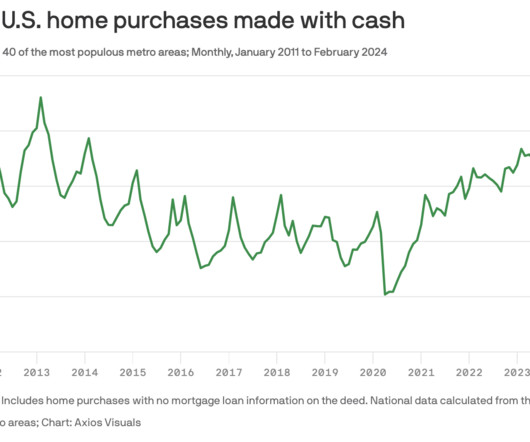

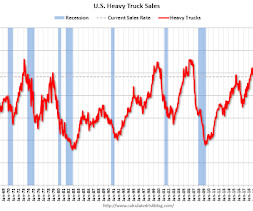

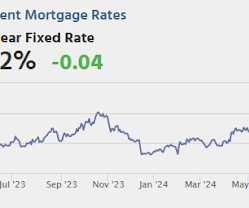

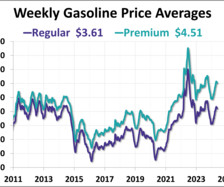

The Misery Index — the combination of Inflation and unemployment — failed as a bearish criticism of the economy. Unemployment remains at 60-year lows, and Inflation has plummeted from 9% down to the 3s. If you have a bearish mindset , and seek confirmation of that perspective, then the next economic critique after the Misery Index you try on for size is “Stagflation.” We have heard the S-word from Jamie Dimon , Stanley Druckenmiller , Bank of America , Barclays , Fox , Ma

Let's personalize your content