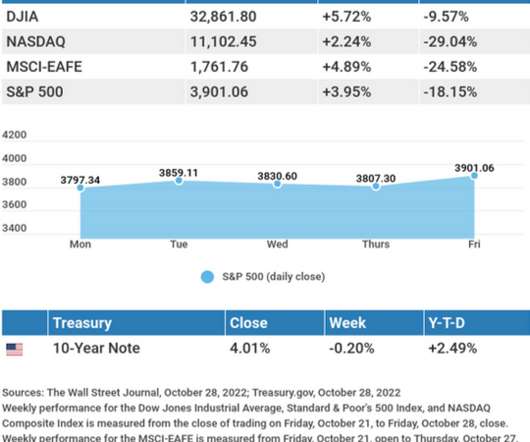

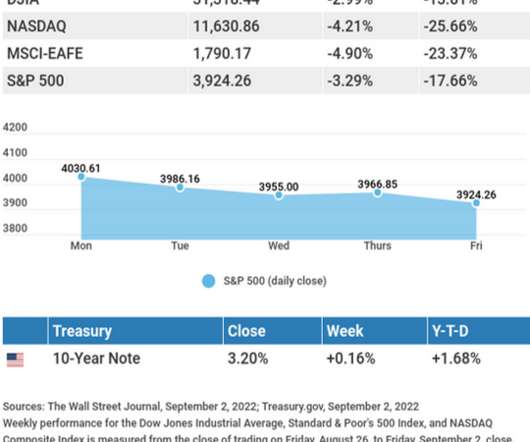

December 2022: Market Valuation, Inflation and Treasury Yields

Advisor Perspectives

JANUARY 6, 2023

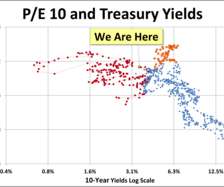

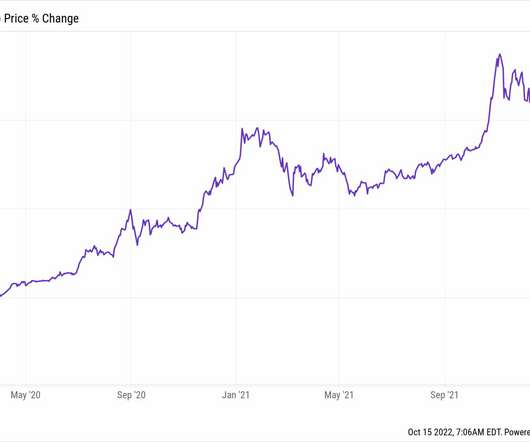

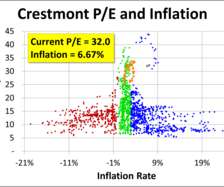

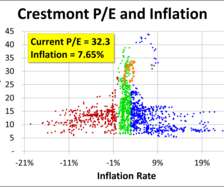

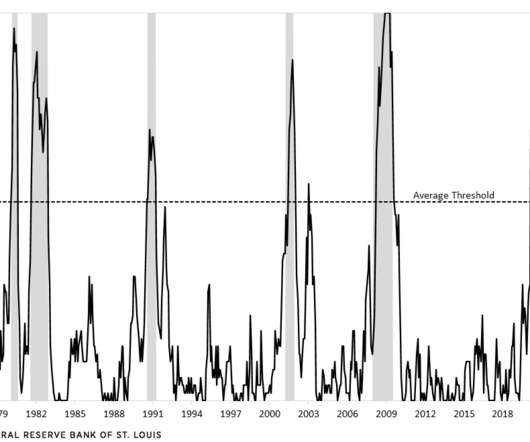

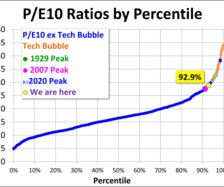

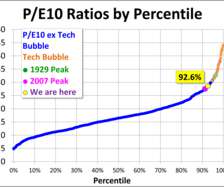

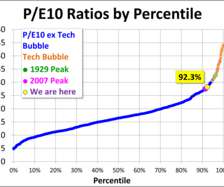

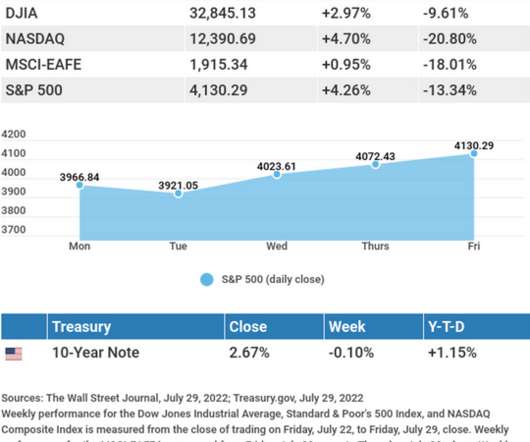

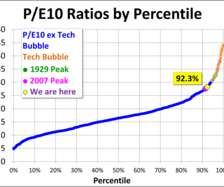

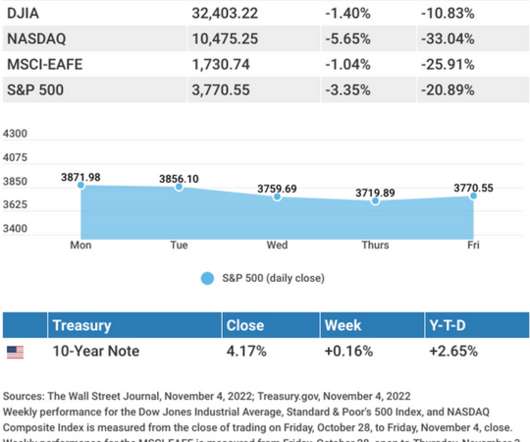

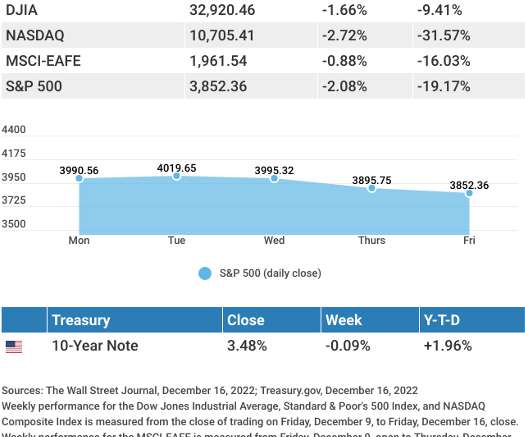

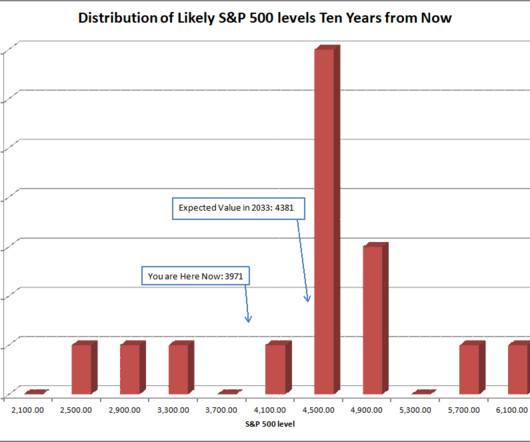

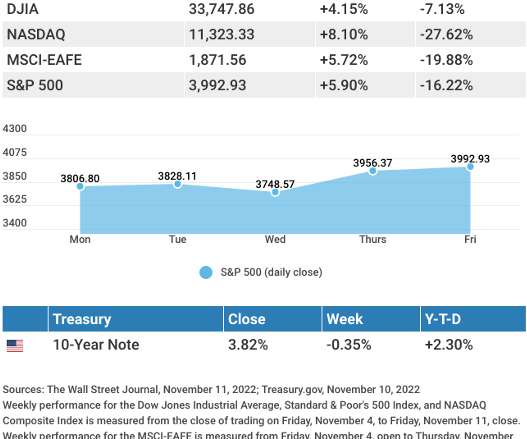

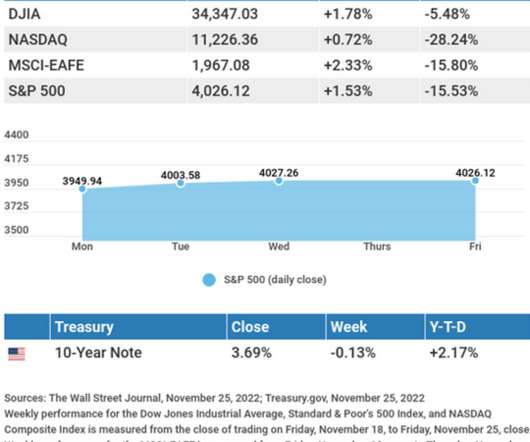

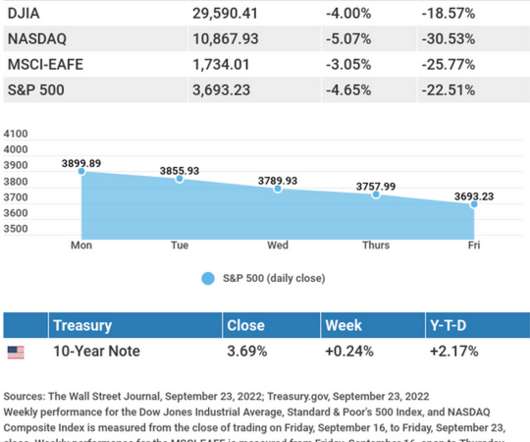

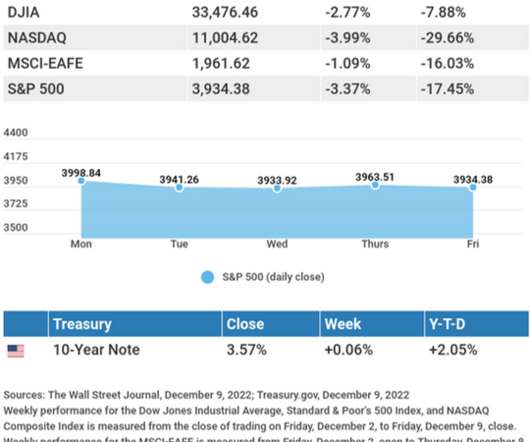

Our monthly market valuation updates have long had the same conclusion: US stock indexes are significantly overvalued, which suggests cautious expectations on investment returns. As of December 30, 2022, it was at 3.88%. On August 4, 2020, the 10-year Treasury yield hit its all-time low of 0.52%.

Let's personalize your content