Malkiel: Enhance Index Investing With Tax-Loss Harvesting

Validea

MAY 26, 2023

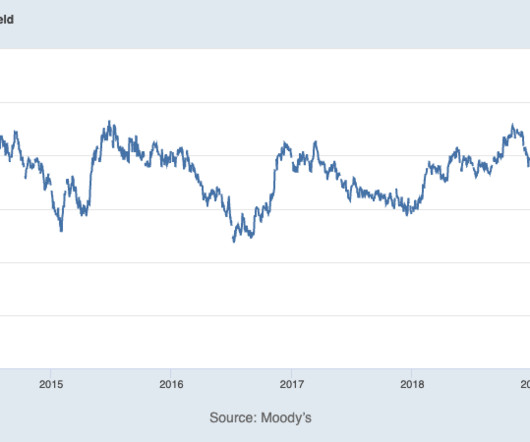

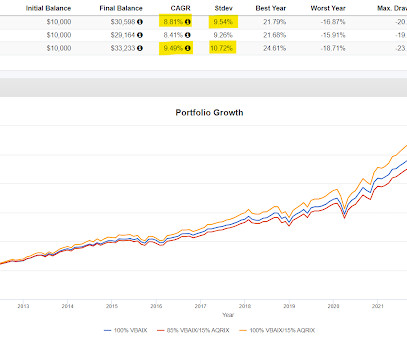

Utilizing software developed by Wealthfront, the firm where he is Chief Investment Officer, Malkiel reaps losses from portfolios throughout the year in order to sow capital gains for other investments, keeping portfolios balanced with a mix of assets and risks.

Let's personalize your content