Wednesday links: sub-optimal portfolios

Abnormal Returns

NOVEMBER 2, 2022

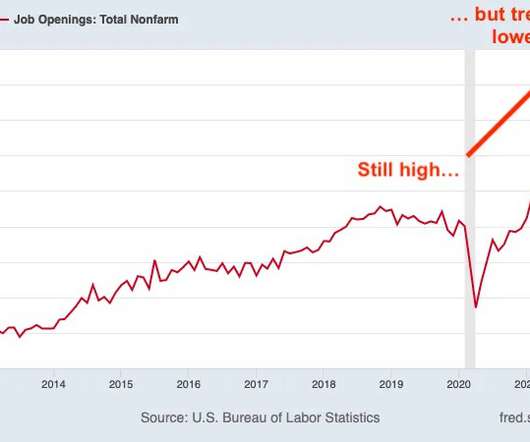

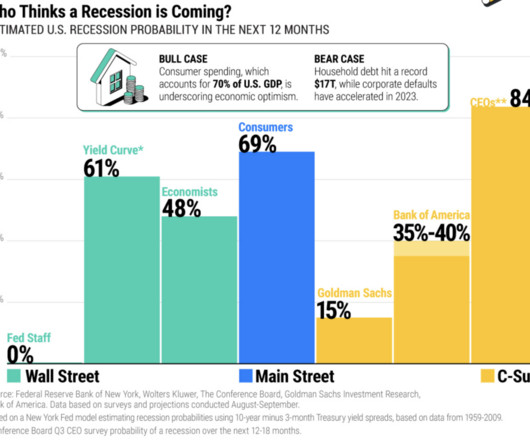

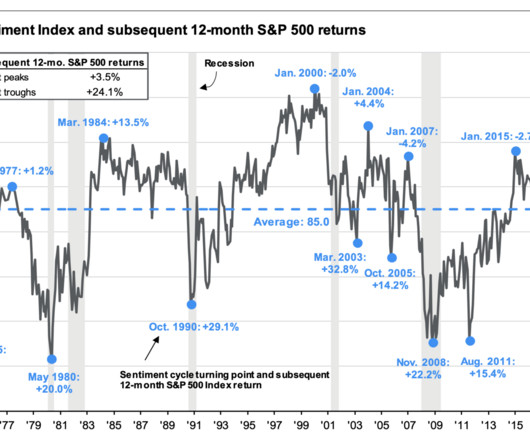

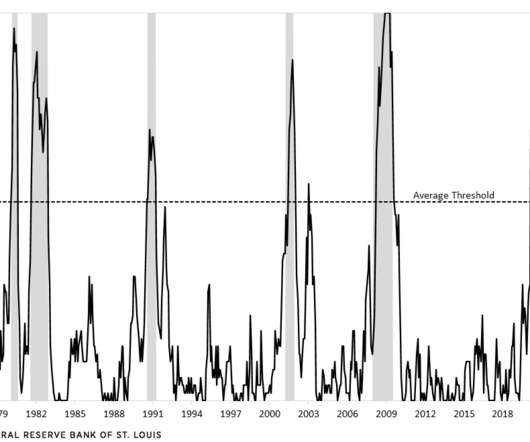

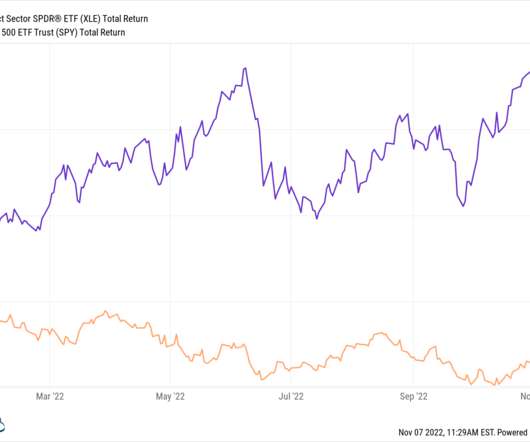

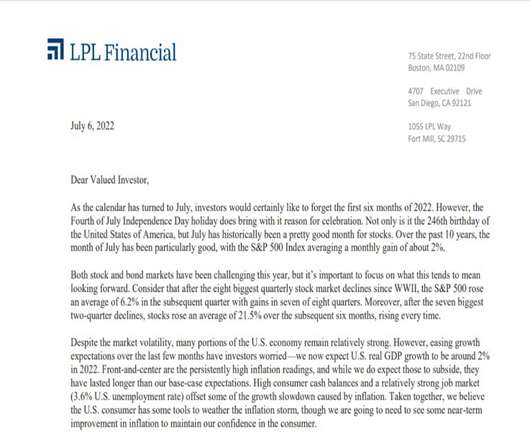

danieldrezner.substack.com) Fund management The shift from mutual funds to ETFs has accelerated in 2022. wsj.com) Economy The 3 month-18 month Treasury spread is almost inverted. The question is whether Elon Musk is the guy to do it. ramp.beehiiv.com) Elon is moving fast and breaking stuff at Twitter.

Let's personalize your content