The 60/40 Portfolio is Back! *after not going away

The Big Picture

APRIL 19, 2023

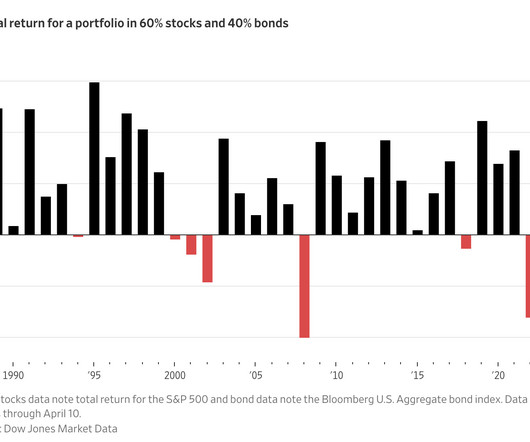

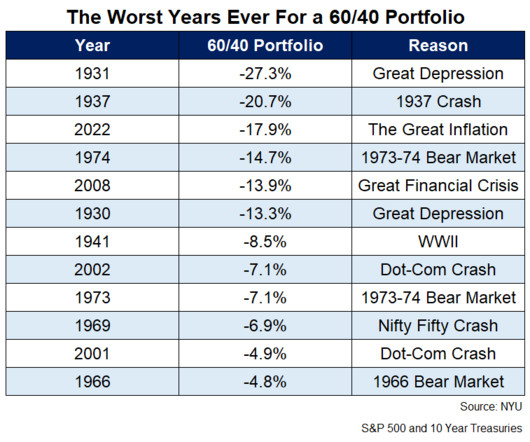

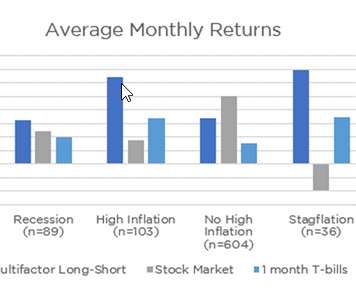

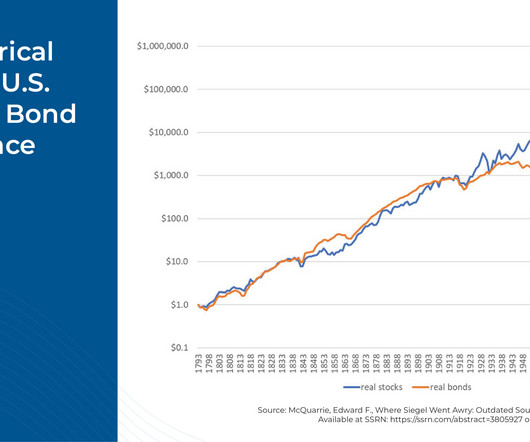

Check out these recent headlines about the classic 60/40 investment strategy 1 : The 60-40 Investment Strategy Is Back After Tanking Last Year BlackRock Ditches 60/40 Portfolio in New Regime of High Inflation Why a 60/40 Portfolio Is No Longer Good Enough The 60-40 portfolio is back Sorry, but all of these headlines utterly miss the point.

Let's personalize your content