Weekly Market Insight – July 11, 2022

Cornerstone Financial Advisory

JULY 11, 2022

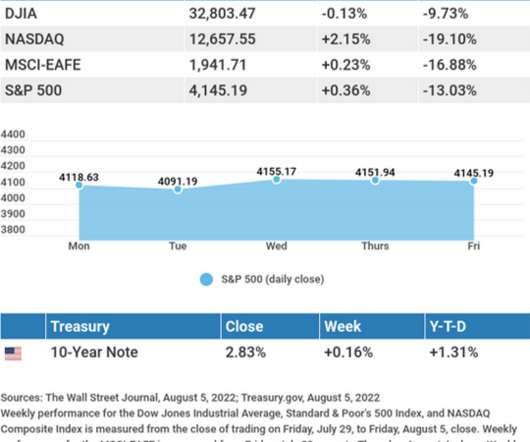

Recession fears were supported by an inversion in the yield curve and updated second-quarter Gross Domestic Product projections indicating the economy is ready to contract. Employers added 372,000 jobs in June, a number that was above economists’ estimates of 250,000. There can only be one of each number in each row and column.

Let's personalize your content