Market Commentary: 7 Reasons the Bull Market Is Alive and Well

Carson Wealth

MAY 13, 2024

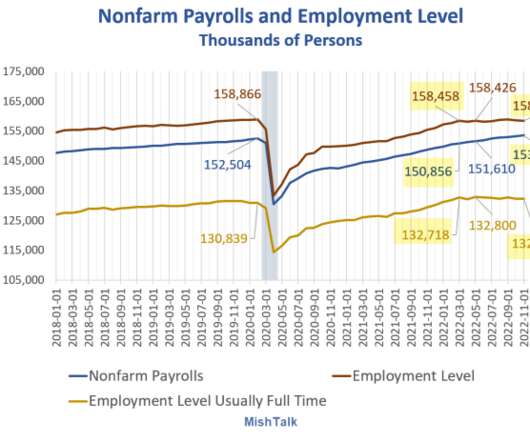

Economic data remains supportive, according to the Carson Leading Economic Indicator, which is pointing to above-trend growth. While some cracks may be forming, the economy remains on firm footing. Admittedly, it can be hard to get a full picture of the economy as the data rolls in week after week. and 28 other countries.

Let's personalize your content