Dollars Are For Spending & Investing, Not Saving

The Big Picture

OCTOBER 20, 2023

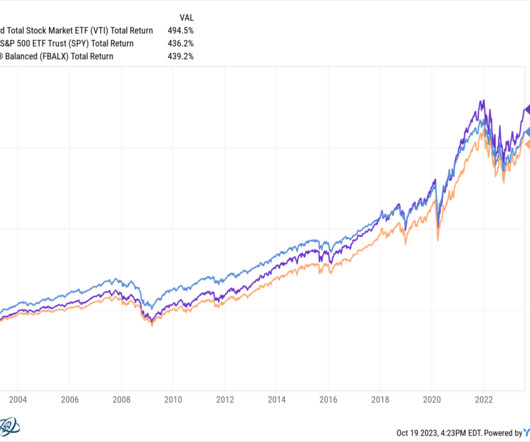

Whether it’s a few decades or a century, the math works the same. Hey, what a very different outcome than suggesting a loss of purchasing power — if you understand money and math, you have actually gained purchasing power. Instead of cherry-picking the S&P 500, what about a simple 60/40 portfolio (e.g.,

Let's personalize your content