Global Leaders Investment Letter - Q4 2020

Brown Advisory

FEBRUARY 1, 2021

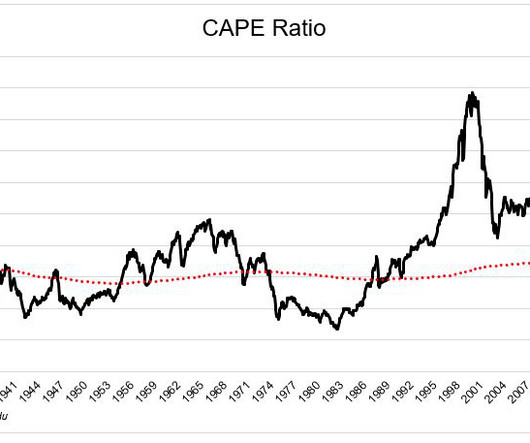

Global Leaders Investment Letter - Q4 2020 jharrison Mon, 02/01/2021 - 08:25 Just want the PDF? One of the most important investing reminders of 2020 was around one of the few sources of investment edge: time. When does crowd psychology take hope for economic return beyond what valuation can support? What is Space?

Let's personalize your content