Operational Risk Management 2023 – Portfolio Go No Go Checklist!

David Nelson

JANUARY 3, 2023

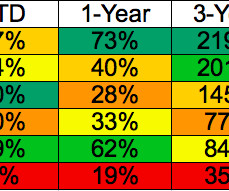

Investors need to do their own due diligence and perform a full ORM review of their portfolio and its ability to navigate the many challenges we face at the start of a new year. From 2017 – 2021 growth outperformed value by a staggering 119%. S&P 500 2 Years. Growth vs Value – There was no alternative. 60-40 is reborn.

Let's personalize your content