Passive vs. Active

The Big Picture

AUGUST 17, 2022

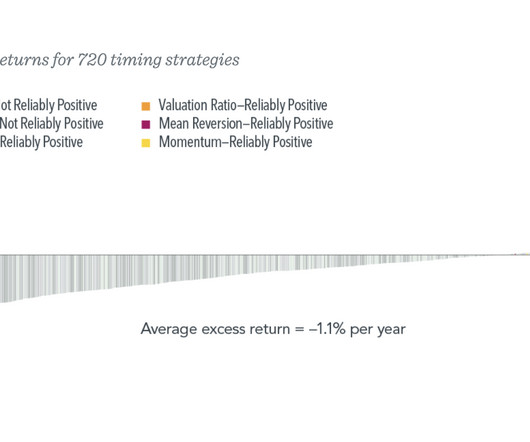

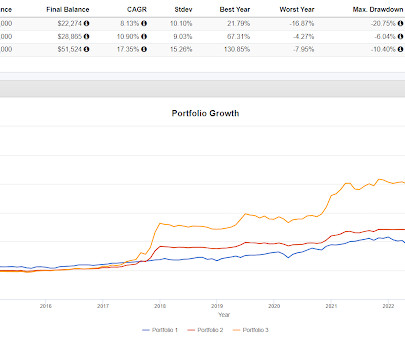

What’s obvious is that cheaper is better than more expensive; that there are inherent costs in managing an active portfolio that include more than just trading and taxes but research, analysis, PMs, etc. But that is not the same as becoming one of the most dominant asset managers in the world. Concentrated portfolio risk.

Let's personalize your content