10 Weekend Reads

The Big Picture

JUNE 24, 2023

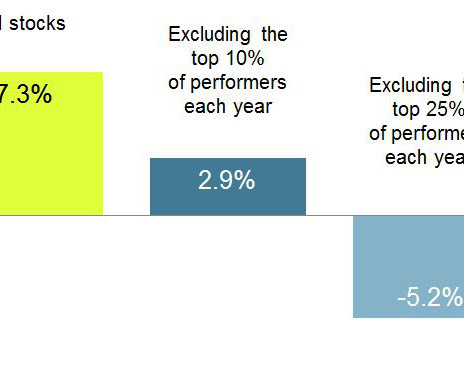

To be a successful investor you need to possess a number of different traits. You need to understand how math, statistics and probabilities work. Pour yourself a mug of coffee, grab a seat outside, and get ready for our longer-form weekend reads: • The Evolution of Financial Advice.

Let's personalize your content