Taxpayer Granted Time to Make Alternate Valuation Election

Wealth Management

JUNE 18, 2025

IRS allows estate to make late alternate valuation date election due to reliance on tax professional.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JUNE 18, 2025

IRS allows estate to make late alternate valuation date election due to reliance on tax professional.

Wealth Management

APRIL 9, 2025

Court of Appeals for the Second Circuit upholds QTIP trust valuation for estate tax, rejecting deduction for settlement payment to widows estate. In Kalikow v. Commissioner, the U.S.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Protect What Matters: Rethinking Finance Ops In A Digital World

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Nerd's Eye View

DECEMBER 27, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that according to a recent study by DeVoe & Company, only 42% of RIAs surveyed have written succession plans and either have begun to implement them or have already done so.

Nerd's Eye View

JANUARY 31, 2025

Which could include measures such as additional time to comply with rules that have been adopted but not yet enforced and perhaps, more broadly, an approach from the SEC that focuses more on whether a firm has robust program controls and a strong fiduciary culture rather than seeking out specific, (sometimes minor) missteps and producing enforcement (..)

Wealth Management

MAY 21, 2024

A cornerstone in strategic planning to optimize clients’ financial legacies.

Nerd's Eye View

JUNE 27, 2025

Which could ultimately lead to a virtuous cycle of attracting more new clients as well as talented advisors who seek to work at growing firms.

Nerd's Eye View

MARCH 6, 2024

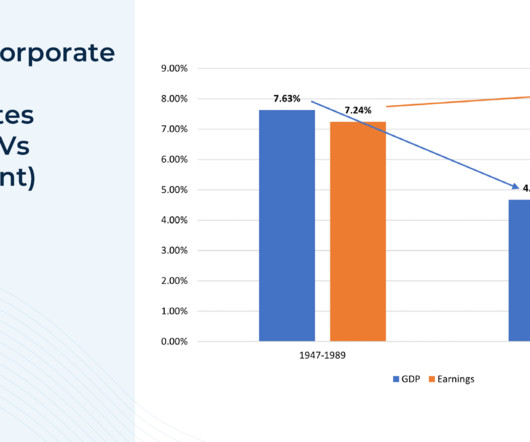

The Shilller Cyclically Adjusted Price-to-Earnings (CAPE 10) Ratio is one example that takes into account current market valuations versus company earnings, generally predicting that the higher the valuation at the beginning of a period the lower the expected return for that period.

Wealth Management

JANUARY 30, 2024

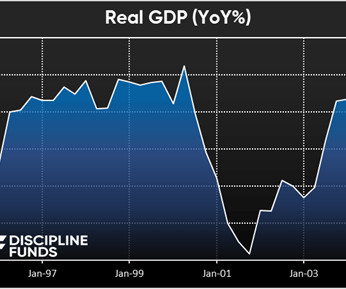

Developments from 1999 through 2019.

Wealth Management

JANUARY 30, 2024

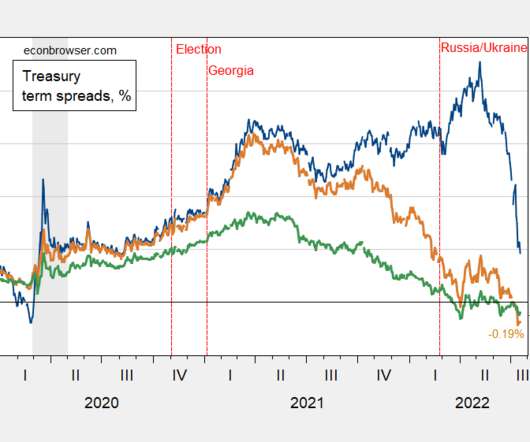

Developments from 2020 to 2023.

Nerd's Eye View

OCTOBER 4, 2023

The expectations for the future economic outlook also appear in the valuations of equities, which tend to reflect how markets anticipate that corporate earnings will grow in the future. And even though U.S.

Wealth Management

MARCH 27, 2024

It may cause trouble down the line If your client is audited.

Nerd's Eye View

MAY 16, 2023

What's unique about Jim, though, is how he has scaled his retainer-based boutique firm to more than $7 million in revenue, a $31 million enterprise valuation, and is growing organically at a 40% growth rate, by providing a high-touch comprehensive advice offering for his business owner niche clientele.

Wealth Management

MARCH 1, 2023

Commissioner provides insights on how to weigh evidence on valuation discounts.

Abnormal Returns

SEPTEMBER 8, 2024

(awealthofcommonsense.com) Early in retirement is the time to do some tax planning. worksinprogress.co) Good luck trying to time the stock market using valuation metrics. whitecoatinvestor.com) Three reasons to buy Josh Brown's new book "You Weren’t Supposed To See That." ritholtz.com) How pour-over coffee got so good.

Abnormal Returns

APRIL 28, 2024

(scienceblog.com) What are to make of the big, and persistent, valuation disparities between large and small caps. carsongroup.com) How much do higher taxes prompt millionaires to relocate? morningstar.com) Additional life advice from Kevin Kelly including 'The highest form of wealth is deciding you have enough.'

The Big Picture

MARCH 18, 2025

We view valuation as a snapshot in time instead of recognizing how it evolves over a cycle, driven primarily by changes in investor psychology. Be tax-aware. We evolved in an arithmetic world, so we are unprepared for the exponential math of finance. Market Mayhem : As investors, we often rely on rules of thumb that fail us.

Abnormal Returns

DECEMBER 19, 2023

on.ft.com) Corporate finance Stock-based compensation makes a big difference for company valuations. indexologyblog.com) Inflation makes tax efficiency all the more important. (advisorperspectives.com) A history of quant investing and the state of the factor zoo. papers.ssrn.com) Research What would it take to see a repeat of U.S.

Harness Wealth

APRIL 30, 2025

Without proper planning, taxes can unexpectedly take a large bite out of the proceeds, potentially reducing financial security and the legacy. When you understand various exit strategies and their tax implications early, you position yourself to make informed decisions that maximize after-tax value while ensuring a smooth transition.

Harness Wealth

MARCH 27, 2025

As dynamic as the secondary market may be, secondaries come with complex tax implications that can significantly impact returns if not properly managed. What are the tax implications of secondary transactions? What are the tax challenges in secondary transactions? What tax strategies optimize secondary investments?

Abnormal Returns

MAY 8, 2023

(financial-planning.com) The biz What variables matter when it comes to RIA valuation. thinkadvisor.com) The latest in advisortech news from April including the SEC's scrutiny of tax-loss harvesting systems. sciencedaily.com) How tax-adjusting a portfolio works in practice.

Nerd's Eye View

APRIL 3, 2024

Notably, the work-from-home movement has resulted in a dramatic drop in office valuations that could lead to a whole host of issues, including lending constraints in the banking sector, which is already sitting on a mountain of unrealized losses on Treasuries and mortgages.

Harness Wealth

APRIL 16, 2025

Tax planning serves as the cornerstone of the entire acquisition deal, extending far beyond a simple checkbox. Every element, from structure to price negotiations, hinges on understanding tax implications for all parties involved. Get it right, and you will have set yourself up for a smooth transition and maximized returns.

Wealth Management

APRIL 20, 2023

How does the court weigh evidence on valuation discounts?

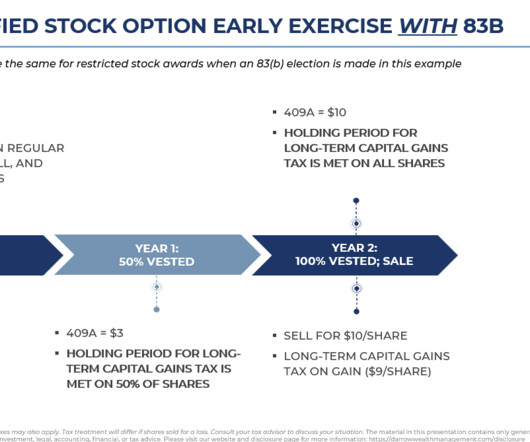

Darrow Wealth Management

JULY 30, 2024

For founders, employees, and executives with stock-based compensation, an 83(b) election can be a powerful tax planning tool. When you make an 83(b) election, you’re opting to pay tax on unvested shares now, instead of when the stock vests. In tax lingo, this is known as substantial risk of forfeiture.

Abnormal Returns

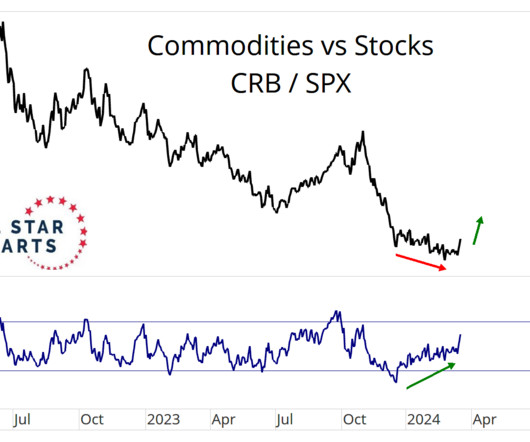

MARCH 17, 2024

Markets Market valuations aren't that helpful in the short term. axios.com) Everybody wants simpler taxes, but it never happens. tker.co) The U.S. yield curve has been inverted for a record amount of time. ft.com) Strategy Why you can ignore all the magazine cover commentary. axios.com) Private equity return dispersion is a problem.

Abnormal Returns

JULY 25, 2023

papers.ssrn.com) Research It makes total sense that equity market valuations are higher today than in the past. morningstar.com) How much are lower interest and tax expenses account for faster earnings growth? (papers.ssrn.com) How disappointment drives a lot of fund outflows. mailchi.mp) Just how predictable are momentum crashes?

Nerd's Eye View

JULY 7, 2023

Also in industry news this week: A recent survey indicates that a strong majority of financial advisory clients have maintained their trust in their advisors despite the investment market setbacks experienced last year A report from the SEC shows that a majority RIAs have mandatory arbitration clauses in their client agreements, a practice that has (..)

Nerd's Eye View

MAY 12, 2023

Also in industry news this week: Why industry groups representing investment advisers and others have blasted an SEC proposal that would significantly expand its Custody Rule A new study suggests that organic client growth and profit margins are the key factors driving RIA valuations, with the firm’s affiliation model having little to no impact (..)

Abnormal Returns

JULY 19, 2022

ft.com) Venture Tomasz Tunguz, "The bid/ask spread in VC is the difference between the post-money valuation between a VC (the bidder) & a company (seller)." abnormalreturns.com) Adviser links: estate tax intricacies. (finance.yahoo.com) Fund managers are starting to end money market mutual fund fee waivers.

Nerd's Eye View

NOVEMBER 4, 2022

We also have a number of articles on taxes and end-of-year planning: The importance for advisors of understanding current RMD rules to ensure their clients take the proper distributions (and avoid a 50% penalty in the process!). ” to pass by the end of the year, while passage of other proposed tax measures appears to be less likely.

The Big Picture

OCTOBER 30, 2024

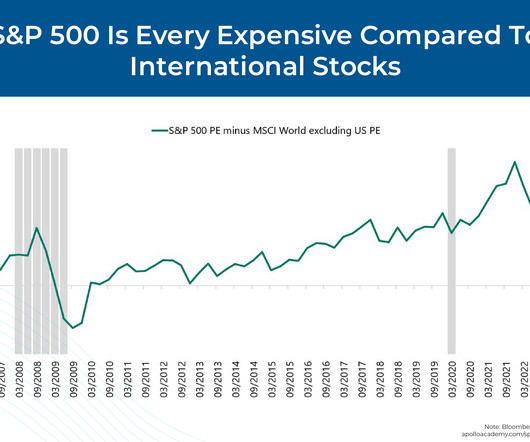

Because of the valuation gap looks about the best it’s ever looked, uh, over the past decade. We’re talking single digit P/E ratios, which is a, a gap that has widened over the past decade, but in particularly the last three to four years, with some of the largest valuation spreads we’ve seen.

Nerd's Eye View

DECEMBER 23, 2022

While RIA M&A activity has been red hot during the past couple of years, a survey suggests that advisors are expecting lower valuations in 2023. A review of financial planning actions, from tax-loss harvesting to charitable giving, that have a December 31 deadline.

Discipline Funds

MAY 28, 2025

For example, I am not a tax expert, but I know enough about taxes and how they relate to personal finance that I can quickly resolve almost any tax related issue and answer questions that might have otherwise relied on an expert. Before long the robots will be producing so much that goods inflation will also collapse.

Darrow Wealth Management

APRIL 23, 2025

For individuals with stock-based compensation, an 83(b) election has the potential to greatly reduce taxes on stock options or restricted stock. Section 83(b) of the tax code gives individuals the ability to accelerate the taxation of their unvested equity grant. What is an 83(b) election?

Carson Wealth

OCTOBER 7, 2024

Carson Wealth’s Thom Hall CFP®️, ChFC ®️, CExP , CEPA Managing Director, Partner & Wealth Advisor and Rick Krebs CPA, CEPA discuss the importance of an accurate valuation when considering a business exit. For a comprehensive review of your personal situation, always consult with a tax or legal advisor.

NAIFA Advisor Today

APRIL 10, 2025

United States has significantly altered the landscape of buy-sell planning for business owners facing potential estate tax exposure. As a result, financial professionals must now navigate new complexities in business valuation and the use of life insurance in these agreements. Supreme Courts 2024 decision in Connelly v.

The Big Picture

FEBRUARY 27, 2023

equity valuations: “Baby-boomers’ huge flow of 401K plan contributions helped to drive equities higher; now that ~70 million Boomers are retiring, when do demographics flip this from a huge positive to a net drag?” This demographic cohort is simply not a seller due to retirement – the tax expenses would be too great.

Trade Brains

JUNE 10, 2025

Hence, listed realty players saw sharp upward revisions in valuation. Add to that the post-tax impact. Interest earned on FDs is taxed according to the investor’s income slab. A 7% interest rate might sound decent at first glance, but for someone in the 30% tax bracket, the effective return drops to around 4.9%.

Darrow Wealth Management

JUNE 24, 2025

Tax implications Interested sellers should always consult a tax professional before accepting a tender offer. There are many tax considerations and nuances which can impact the outcome. But in general, the tax consequences are as follows. Speak with your tax advisor and the company to find out more.

Harness Wealth

APRIL 30, 2025

In this article, well examine the nature of IRS audits, the common audit red flags that result in IRS scrutiny, and how professional tax advisors can help reduce the risk of you being audited. An IRS audit is a formal review of your financial records to verify their accuracy and compliance with tax laws.

Zoe Financial

MARCH 3, 2025

despite beating earnings expectations, showing high valuation pressure. Nothing in these materials is intended to serve as personalized tax and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Nvidia: Fell 8.5%

Alpha Architect

FEBRUARY 3, 2023

In their 1961 paper, “Dividend Policy, Growth, and the Valuation of Shares,” Merton Miller and Franco Modigliani famously established that dividend policy should be irrelevant to stock returns.

Abnormal Returns

FEBRUARY 16, 2023

howardlindzon.com) Private assets Why private equity needs much better valuations. axios.com) Funds Tax efficiency is the secret sauce of ETFs. (nytimes.com) AI requires a lot of semiconductors. ft.com) Why where investors mark the portfolios can be all over the place. pragcap.com) Fidelity is hiring!

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content