Why does Corporate Governance matter in investments?

Truemind Capital

MARCH 12, 2024

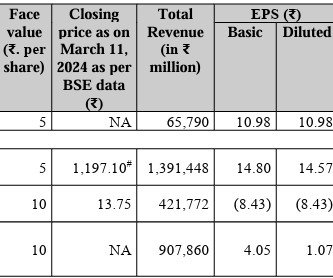

Imagine you have been told about an investment opportunity in a business. However, one fine day people come across some disturbing red flags regarding corporate governance practices in the company. The fundamental aspect that is killed on recognizing glaring corporate governance issues is trust in accounting practices.

Let's personalize your content