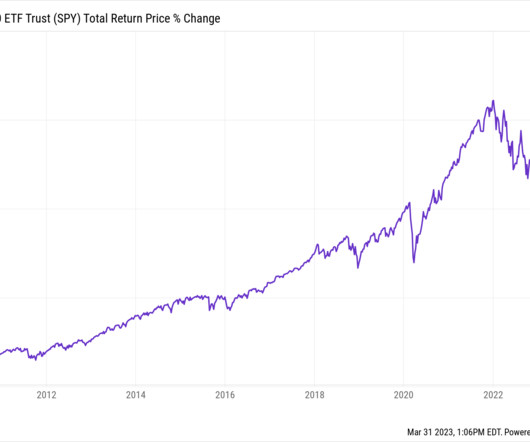

Everyone Is Overweight Cash and Underweight Stocks

The Reformed Broker

MARCH 28, 2023

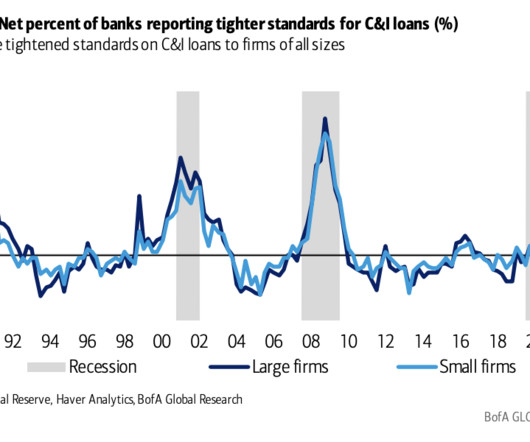

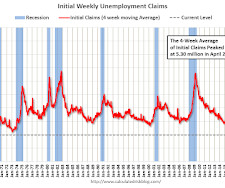

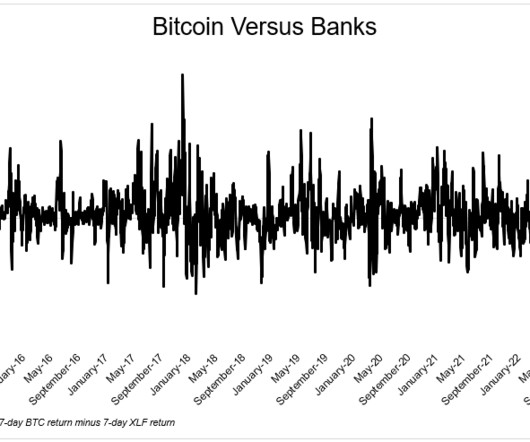

Join Downtown Josh Brown and Michael Batnick for another round of What Are Your Thoughts? On this week’s episode, Josh and Michael discuss the biggest topics in investing and finance, including: ►Lending Shock – Shocks to bank lending standards do not fade away quickly. They persist and cause recessions. ►Are Banks Screwed? – “Since peaking almost exactly one year ago, deposits at all domestic.

Let's personalize your content