What’s Wrong With Macroeconomic Uncertainty Indexes

The Big Picture

AUGUST 8, 2023

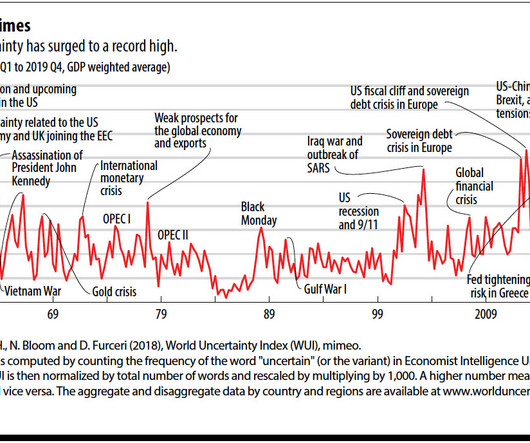

I love FRED — I am a big user of their charts and data (and even their swag ). Where I go full heterodox are in things like the Macroeconomic Uncertainty Index, which is a recent addition to FRED’s awesome database. It is a “monthly measure of how unpredictable overall economic conditions are 1 month, 3 months, and 1 year ahead.” FRED’s post on it observed that “Economists Kyle Jurado, Sydney Ludvigson, and Serena Ng use a set of 132 individual macroeconomic t

Let's personalize your content