Five Shifts Transforming Advisor Growth

Advisor Perspectives

OCTOBER 11, 2023

The financial planning landscape is undergoing a great transformation, driven by emerging trends that have accelerated in recent years.

Advisor Perspectives

OCTOBER 11, 2023

The financial planning landscape is undergoing a great transformation, driven by emerging trends that have accelerated in recent years.

The Big Picture

OCTOBER 20, 2023

“I need the US Dollar to be a store of value between the time I make it until I spend it, invest it, pay my taxes with it, or give it away. It does that splendidly.” 1 Today, we’re going to look at a perennial (un)favorite #chartfail. To be more precise, I want to discuss the type of chart that reflects a fundamental misunderstanding of the nature of money, currency, spending, investing, and taxes.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The Big Picture

OCTOBER 2, 2023

We all love to use quotations in our arguments. It’s both an appeal to higher authority as well as social proof ( Hey! I’m not the only one who believes this stuff ). I find it useful occasionally to go back to first principles and reconsider the sources that have influenced my thinmking. Along those lines, here are in chronological order, the thinkers who have helped shape how I view the world view, including how I philosophically think about the economy, markets, and investing.

The Reformed Broker

OCTOBER 24, 2023

Conservatory at Biltmore, by Ann Vasilik via Our State There are four million households in North Carolina. Approximately half of those households (1.922 million) are comprised of a married male and female with children. Another half million are a female head of household with kids. There’s 180,000 or so male-led homes with children and then 1.4 million non-family households.

Speaker: Hilary Akhaabi, PhD - Founder, Chief Financial & Operations Officer at Go Africa Global

In the fast-paced world of corporate finance, staying ahead of the curve is crucial for sustainable growth and profitability. This exclusive webinar with leading expert Hilary Akhaabi, PhD, will teach you practical ways to navigate complex financial landscapes and enhance your company's revenue management capabilities. Whether you're aiming to refine your financial strategies or seeking innovative solutions to drive performance, this new session is for you!

Abnormal Returns

OCTOBER 9, 2023

Podcasts Dan Haylett talks with George Kinder on the true impact of Life Planning on retirement. (humansvsretirement.com) Daniel Crosby talks financial wellness and therapy with Amanda Clayman. (standarddeviationspod.com) Brendan Frazier talks about why advisers should shift from "advice giver" to "thinking partner." (wiredplanning.com) Michael Kitces talks with Brett Danko who is the Founder of Brett Danko Educational Center, and the CEO and Managing Partner for Main Street Financial Solutions.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

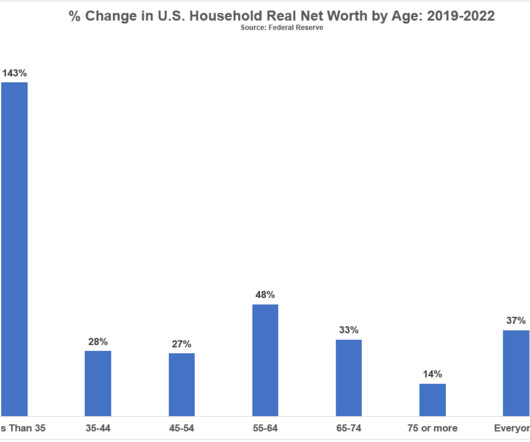

A Wealth of Common Sense

OCTOBER 22, 2023

Every three years the Federal Reserve puts out a report that summarizes the changes to family finances in the United States. I know averages, aggregates, medians and such never tell the entire story but directionally this stuff can be helpful in terms of understanding where things stand. Let’s dig in. Real median net worth for U.S. households was up a stunning 37% from 2019-2022.

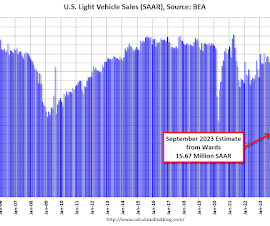

Calculated Risk

OCTOBER 3, 2023

Wards Auto released their estimate of light vehicle sales for September: September U.S. Light-Vehicles Sales Bounce Back Despite Gloomy Conditions (pay site). Hard to say exactly how much but sales could have been slightly stronger in September if not for some lost inventory caused by production cuts related to plant shutdowns from UAW strikes at Ford, General Motors and Stellantis.

The Big Picture

OCTOBER 5, 2023

“If you want to read a moral condemnation of crypto theft, you can get that anywhere. You go to Michael Lewis for character and story.” – Matt Levine Michael Lewis’s new book “ Going Infinite: The Rise and Fall of a New Tycoon ” came out this week. I got a copy earlier after signing an NDA that I would not disclose anything about it until after the publication date, which was Tuesday, October 3rd.

The Reformed Broker

OCTOBER 17, 2023

Join Downtown Josh Brown and Michael Batnick for another round of What Are Your Thoughts? On this week’s episode, Josh and Michael discuss the biggest topics in investing and finance, including: ►Earnings – “Average commercial and consumer loans were both down from the second quarter as higher rates and a slowing economy have weakened loan demand, and we’ve continued to take some credit tighteni.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Abnormal Returns

OCTOBER 31, 2023

Factors Why corporate bond factor research is more challenging. (papers.ssrn.com) Why do stocks with high idiosyncratic volatility underperform? (alphaarchitect.com) Momentum Fund investors are momentum chasers. (klementoninvesting.substack.com) Momentum in the sports betting markets. (papers.ssrn.com) Research Do stocks really become less risky over the long run?

Carson Wealth

OCTOBER 5, 2023

By Beth Schanou, JD, CExP, Senior Wealth Planner Who wants to spend an afternoon thinking about their mortality? No one, which is why more than half of Americans don’t even have a will. The foundation of your estate plan is a Last Will and Testament. Without a will, you are leaving the disposition of your assets and the guardianship of your minor children to a court.

A Wealth of Common Sense

OCTOBER 20, 2023

There’s this guy on Twitter, Paul Fairie, who does these threads using old newspaper clippings to show how the stuff we worry about today is the same stuff people have been worrying about for decades. There was one called a brief history of we are raising a generation of wimps. Every older generation thinks this (and will always think this…it’s called progress).

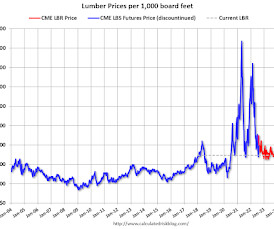

Calculated Risk

OCTOBER 3, 2023

Here is another monthly update on lumber prices. SPECIAL NOTE: The CME group discontinued the Random Length Lumber Futures contract on May 16th. I've now switched to a new physically-delivered Lumber Futures contract that was started in August 2022. Unfortunately, this impacts long term price comparisons since the new contract was priced about 24% higher than the old random length contract for the period both contracts were available.

Speaker: Joe Buhrmann, MBA, CFP®, CLU®, ChFC® Senior Financial Planning Practice Management Consultant eMoney Advisor

During an era of evolving consumer preferences, the banking sector is undergoing a profound shift. As customers continue to broaden their perspectives, banking professionals must support their customers' financial wellness by providing holistic financial advice that aligns with individual goals and circumstances. Without adapting, financial institutions will find that loyalty may crumble amid uncertainty.

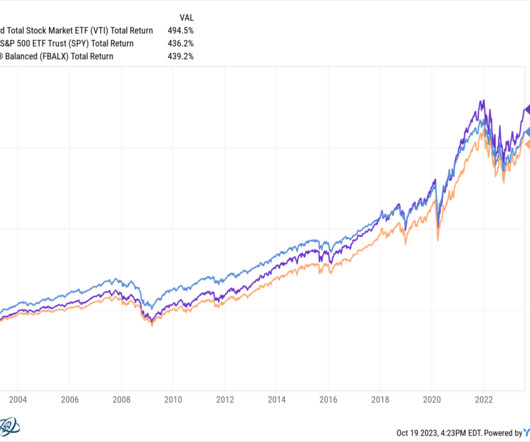

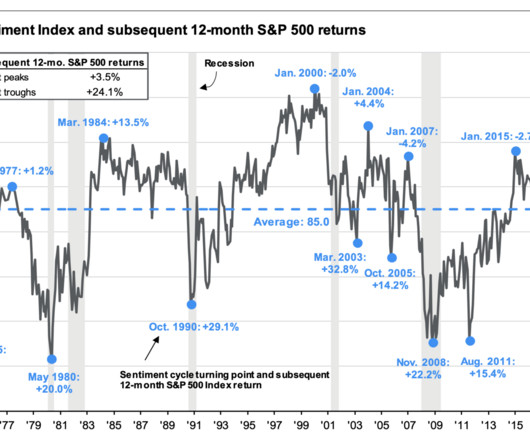

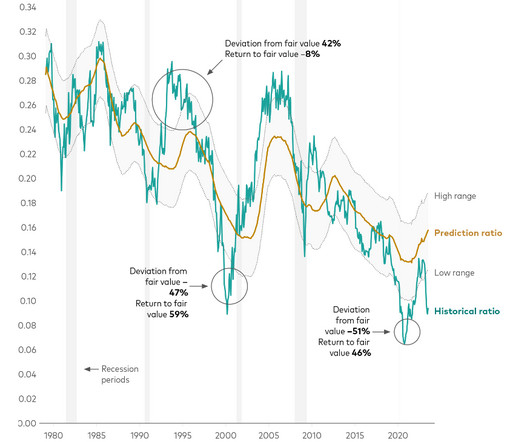

The Big Picture

OCTOBER 19, 2023

One of my favorite responsibilities as chief investment officer at Ritholtz Wealth Management is the quarterly conference call I do for our clients. I run through 30 charts in 30 minutes that explain where we are in the economic cycle, what markets are doing, and what it means to their portfolios. I like to finish with a thought-provoking, often “investing-adjacent” idea they might not have previously considered.

Wealth Management

OCTOBER 30, 2023

Former rep Sidney Lebental is citing FINRA’s legal sparring match with Alpine Securities to halt disciplinary proceedings against him. Meanwhile, FINRA has responded to Alpine’s allegations.

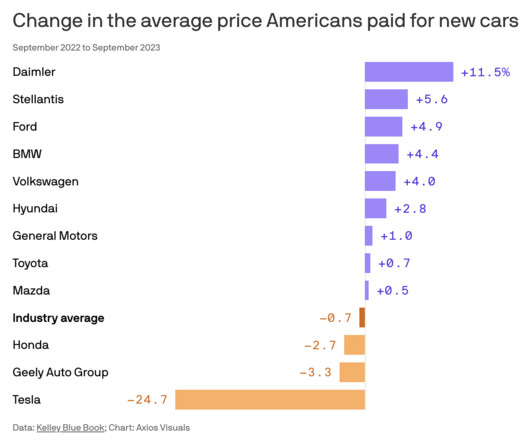

Abnormal Returns

OCTOBER 21, 2023

EVs The case for plug-in hybrid vehicles, i.e. PHEVs. (ritholtz.com) Tesla ($TSLA) prices are down some 25% year-over-year. (axios.com) States are taxing EVs to make up for lost gas tax revenue. (washingtonpost.com) Big cities have unique challenging providing EV charging support. (politico.com) How much do EV batteries cost? (visualcapitalist.com) Transport Fatality rates for the youngest drivers have fallen over the past 20 years.

Carson Wealth

OCTOBER 9, 2023

Stocks had a solid late-week reversal higher, even as many worries and concerns piled up. From the U.S. House not having a speaker for the first time ever, to yields soaring, to deficits and spending, the list of worries was high. But there’s an old saying that the market tends to rally on a wall of worry. As we noted in early August, there was a little too much optimism as long-term bears turned bullish, opening the door for seasonal third-quarter weakness.

Speaker: Carolina Aponte - Owner and CEO, Caja Holdings LLC

In today's rapidly changing business environment, building a resilient balance sheet is crucial to the survival of any business. A resilient balance sheet allows a company to withstand financial shocks and adapt to changing market conditions. To achieve this, companies need to focus on key strategies such as maintaining adequate liquidity, managing debt levels, diversifying revenue streams, and prioritizing profitability over growth.

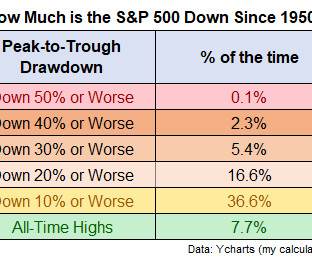

A Wealth of Common Sense

OCTOBER 27, 2023

Here’s something Henry Blodget wrote about notorious stock market bear John Hussman: Every historical indicator Hussman is looking at is suggesting that the stock market is wildly overvalued and headed for a period of lousy returns. How lousy? John Hussman thinks there’s a good chance the stock market will soon crash 40-50 percent. And even if the market doesn’t crash, Hussman thinks stocks are priced to.

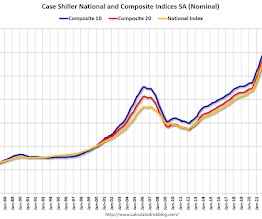

Calculated Risk

OCTOBER 31, 2023

S&P/Case-Shiller released the monthly Home Price Indices for August ("August" is a 3-month average of June, July and August closing prices). This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index. From S&P S&P CoreLogic Case-Shiller Index Continues to Trend Upward in August Click on graph for larger image.

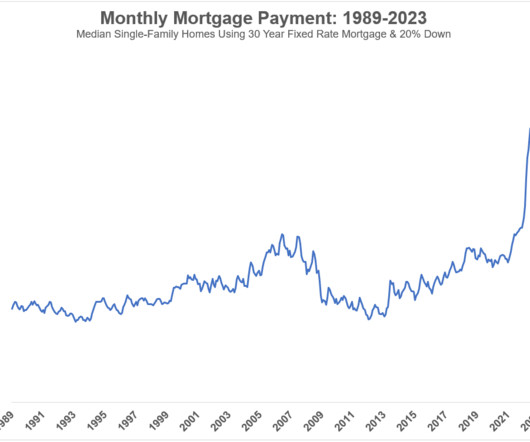

The Big Picture

OCTOBER 23, 2023

The chart in this morning’s reads shows what it is going to cost to fund the interest payments on the federal debt. It’s gone vertical as rates have moved from effectively 0 to over 5%. When rates were zero all of corporate America refinanced, lowering the cost of their debt to historically low levels. Households did the same; today 61% of homeowners with a mortgage are paying 4% or less in interest.

Alpha Architect

OCTOBER 5, 2023

Over the very long term, while value stocks have been less profitable and have had slower growth in earnings than growth stocks, they have provided higher returns. International Value Stocks Offering “More Bang for the Buck” was originally published at Alpha Architect. Please read the Alpha Architect disclosures at your convenience.

Speaker: Wayne Spivak, President and CFO of SBA * Consulting Ltd., Industry Writer, Public Speaker

If you’re lost in the world of spend management needs and your GAP analysis is lacking perspective on the future state of your business performance, listen up! With the advancement of technology, the implementation of spend management best practices and concrete GAP analyses is more streamlined and accessible than ever before. And while this may sound like great news for you and your clients, it won’t be worthwhile unless you have the latest techniques to back up your ambitions!

Abnormal Returns

OCTOBER 8, 2023

Top clicks this week The stock market is coming to terms with higher interest rates (for longer). (awealthofcommonsense.com) Why simplicity in investing can help reduce errors. (mrzepczynski.blogspot.com) Why some people like to research and hold individual stocks instead of funds. (investmenttalk.co) How major asset classes performed in September 2023.

The Irrelevant Investor

OCTOBER 27, 2023

You cannot be online and think things are getting better. Let me show you one example. This was on the front page of The Wall Street Journal yesterday. Instead of a headline like “U.S. Economy Grows at Fastest Pace in Two Years,” they wrote: “U.S. Economy’s Summer Surge May Not Last” And below it, “There are warning signs underlying the eye-popping numbers.” Charlie Munger once.

A Wealth of Common Sense

OCTOBER 29, 2023

There are always going to be winners and losers in the system under which we operate. Some people will always be doing better than you while some people will always be people doing worse than you. Right or wrong, that’s a feature, not a bug. Most of the time it could take years, decades or even generations to separate the winners from the losers in the economy.

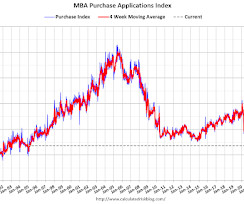

Calculated Risk

OCTOBER 4, 2023

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey Mortgage applications decreased 6.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending September 29, 2023. The Market Composite Index, a measure of mortgage loan application volume, decreased 6.0 percent on a seasonally adjusted basis from one week earlier.

Speaker: Lynnette Khalfani-Cox, The Money Coach®

Niche markets represent a huge opportunity for the financial services industry in America. From college students and women to communities of color and low-to-moderate-income households, niche populations have specialized financial needs – but they often underutilize many valuable financial products and services. How can you better connect with these consumers?

The Big Picture

OCTOBER 12, 2023

In August of 2022, I explained how Amazon became ordinary. Today I want to discuss how they have become bad. Since I first discussed the companies that lost my affection during the pandemic nearly two years ago, Amazon continues to stand out as delivering an ever-worsening set of experiences. I wanted to wait until after the (faux retail holiday) Prime Day(s) ended before sharing a few tales of further (to use Cory Doctorow’s phrase) “ Enshittification.” There are many problem

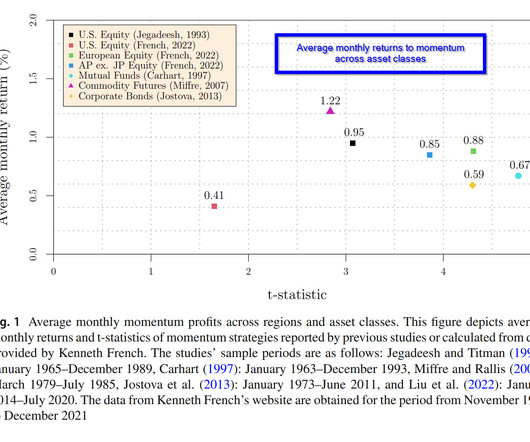

Alpha Architect

OCTOBER 16, 2023

The Jegadeesh and Titman (1993) paper on momentum established that an equity trading strategy consisting of buying past winners and selling past losers, reliably produced risk-adjusted excess returns. The Jegadeesh results have been replicated in international markets and across asset classes. As this evidence challenged and contradicted widely accepted notions of weak-form market efficiency, the academic community took notice and started churning out research.

Abnormal Returns

OCTOBER 14, 2023

Transport How to make cars safer for pedestrians. (bbc.com) Stockholm has banned petrol and diesel vehicles from the city center. (semafor.com) How AI is finding its way into the cockpit. (newatlas.com) Electric garbage trucks? Yes, please. (thecooldown.com) Offshore wind The world’s largest floating offshore wind farm is now operational. (thecooldown.com) Offshore wind has a cost problem.

Let's personalize your content