The Rise of Amazon

The Irrelevant Investor

AUGUST 28, 2019

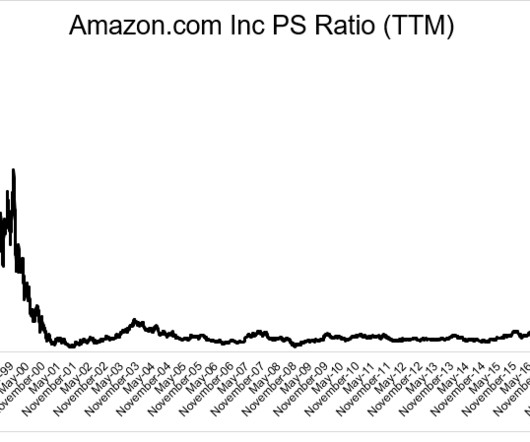

"The losses were a lot bigger than expected." Mary meeker said this on a podcast called Land of the Giants , an excellent six-part series on the rise of Amazon. What she was referring to were the losses Amazon experienced in its first *21 quarters as a public company*. Over that time, cumulative net income was -$2.86 billion. As bottom line losses piled up, top line growth averaged a blistering 229%.

Let's personalize your content