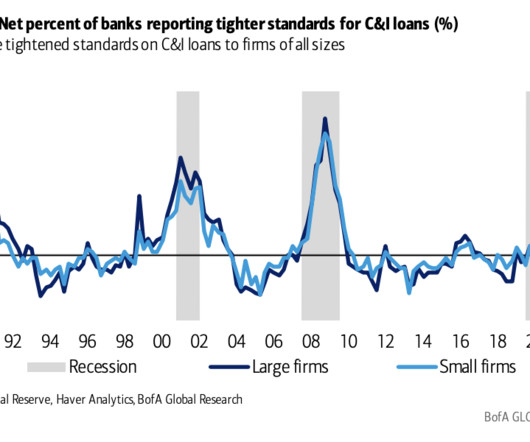

A shock to lending standards

The Reformed Broker

MARCH 27, 2023

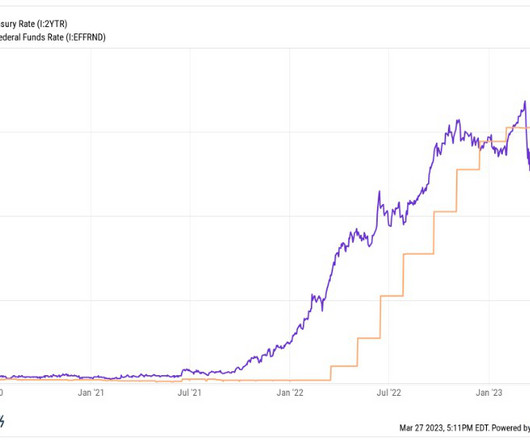

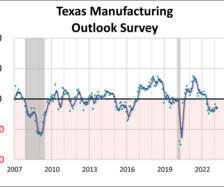

This is it. The only chart you need to concern yourself with now if you’re trying to figure out where the economy is heading. Construction and Industrial (C&I) loans are a $2.8 trillion business (approximately) for banks all over the country. If they roll over, we have a soft landing. If they roll over hard, we have a hard landing. It’s not complicated, the only thing that’s up in the air is the tim.

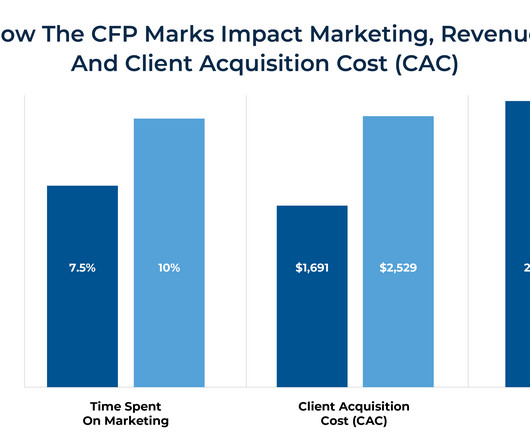

Let's personalize your content