Now listen up and listen good

The Reformed Broker

FEBRUARY 1, 2023

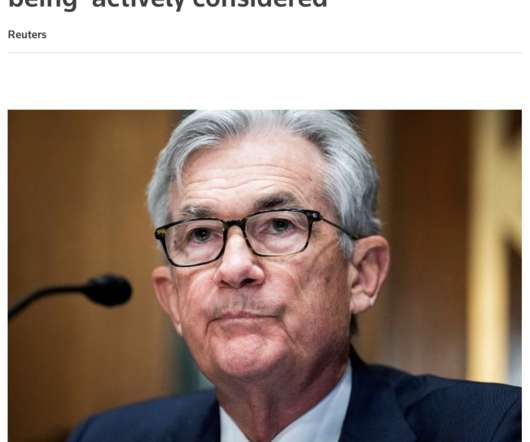

Now listen up and listen good. Last May 4th, Fed Chairman Jay Powell told a press conference that “A 75 basis point increase is not something that the committee is actively considering.” Five weeks later, the Fed hiked rates by 75 basis points. Then he did another 75 basis points, then another 75 basis points, then another 75 basis points.

Let's personalize your content