10 Tuesday AM Reads

The Big Picture

NOVEMBER 21, 2023

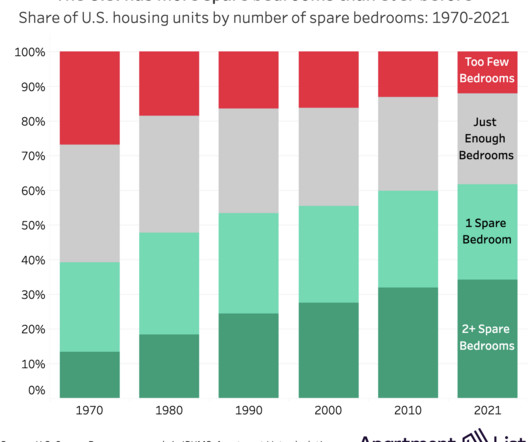

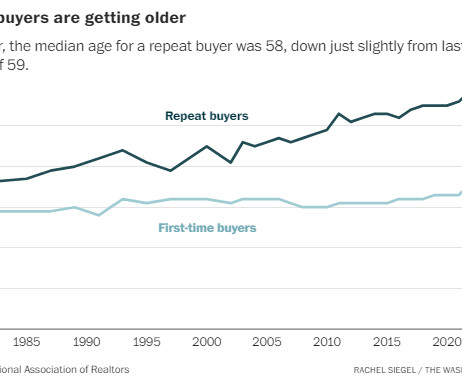

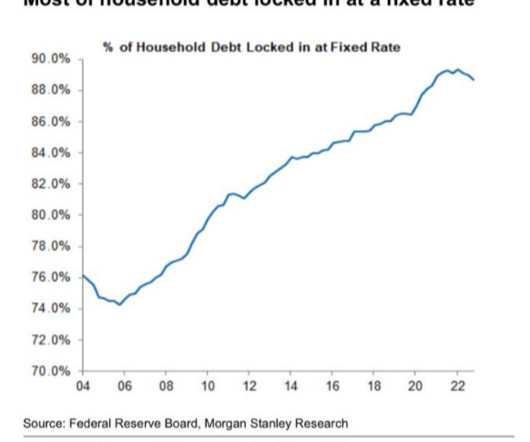

My Two-for-Tuesday morning train WFH reads: • The Share of Americans Who Are Mortgage-Free Is at an All-Time High : Almost 40% of US homeowners own their homes outright as of 2022—many of them baby boomers who refinanced when rates were low. ( Businessweek ) see also Why Your Office Space Continues to Shrink : Despite more than a billion square feet of empty office space in the US, a return to roomier layouts and private offices does not seem to be in the cards. ( Bloomberg ) • Satoshi Is Black

Let's personalize your content