A Roadmap For Solo RIAs Making Their First Hire

Nerd's Eye View

JULY 31, 2023

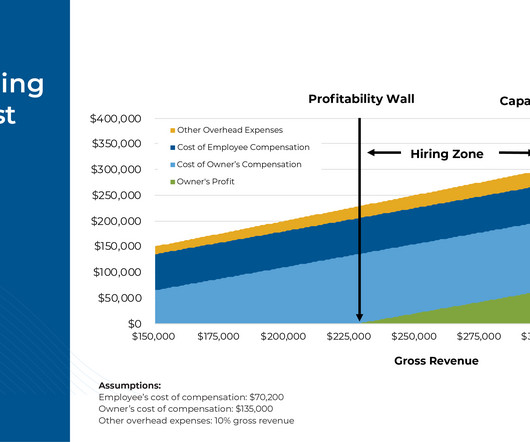

Many financial advisors who launch solo advisory firms do so with the intention of adding more employees once the firm becomes big enough to support them. And while conceptually it makes sense that the firm will be ready to hire its first employee at some point, in practice, there often isn't a lot of clarity about the right time to actually make an initial hire.

Let's personalize your content