Tuesday links: the vibes discourse

Abnormal Returns

JANUARY 2, 2024

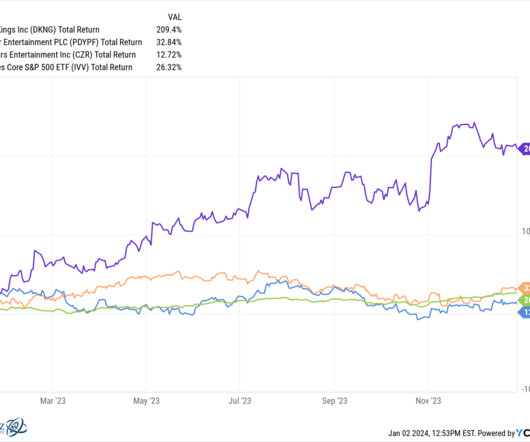

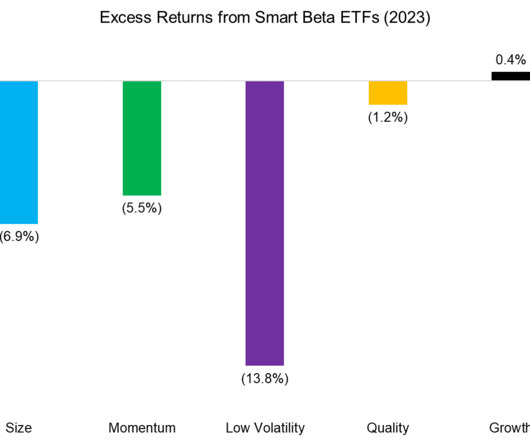

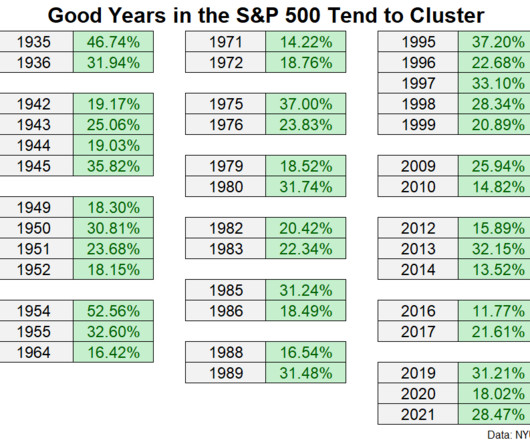

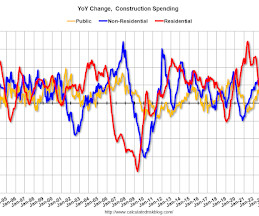

Markets How major asset classes performed in December 2023. (capitalspectator.com) 2023 was a welcome respite from 2022, market-wise. (awealthofcommonsense.com) Growth stocks have trounced value over the past decade no matter the geography. (albertbridgecapital.com) Strategy 10 predictions for 2024 including 'The economy overheats.' (theirrelevantinvestor.com) Don't get caught sitting in cash in 2024.

Let's personalize your content