How Advisors Can Help Business Owners

Wealth Management

OCTOBER 22, 2024

Holistic advisory services like succession planning, retirement strategies and estate planning are needed now more than ever.

Wealth Management

OCTOBER 22, 2024

Holistic advisory services like succession planning, retirement strategies and estate planning are needed now more than ever.

Abnormal Returns

OCTOBER 22, 2024

Trend following Why trend following is unique. (mrzepczynski.blogspot.com) If you want trend following returns just do trend following. (klementoninvesting.substack.com) Research Want small cap exposure? Go microcap. (mailchi.mp) What ideal diversification looks like. (caia.org) AI is becoming table stakes for hedge funds. (alphaarchitect.com) European investors still prefer dividends over buybacks.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

OCTOBER 22, 2024

BlackRock’s ETF head told CNBC that 13F filings have revealed that 80% of investors in spot bitcoin ETFs are direct investors and 75% have never previously owned its ETFs. J.P. Morgan Asset Management has split its alternative investment business into two segments, reports FundFire. These are among the investment must reads we found this week for wealth advisors.

Abnormal Returns

OCTOBER 22, 2024

Strategy Why we diversify. (awealthofcommonsense.com) On the importance of portfolio rebalancing. (thefinancialbodyguard.com) Pessimists persist because we forget their poor predictions. (whitecoatinvestor.com) Crypto Stablecoins are emerging as the killer use case. (theblock.co) Why the identify of Satoshi matters. (bloomberg.com) The blockchain is coming for real estate.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Wealth Management

OCTOBER 22, 2024

AlphaCore founder Dick Pfister describes the firm’s investment approach that places alternatives at the core of the service offering.

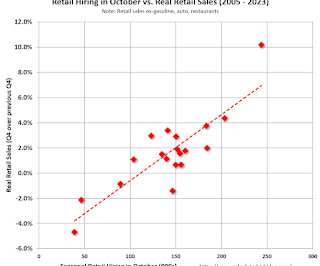

Calculated Risk

OCTOBER 22, 2024

Every year I track seasonal retail hiring for hints about holiday retail sales. At the bottom of this post is a graph showing the correlation between October seasonal hiring and holiday retail sales. Here is a graph of retail hiring for previous years based on the BLS employment report: Click on graph for larger image. This graph shows the historical net retail jobs added for October, November and December by year.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

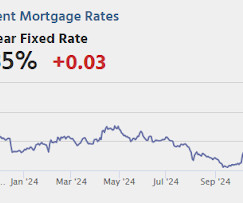

Calculated Risk

OCTOBER 22, 2024

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Wednesday: • At 7:00 AM ET, The Mortgage Bankers Association (MBA) will release the results for the mortgage purchase applications index. • At 10:00 AM, Existing Home Sales for September from the National Association of Realtors (NAR). The consensus is for 3.89 million SAAR, up from 3.86 million in August. • At During the day, The AIA/Deltek's Architecture Billings Index for September (a leading indicator for com

Wealth Management

OCTOBER 22, 2024

Revenue Procedure 2024-40 reveals what’s new for the 2025 tax year.

Calculated Risk

OCTOBER 22, 2024

Today, in the CalculatedRisk Real Estate Newsletter: California Home Sales Up 5% SA YoY in September Excerpt: The National Association of Realtors (NAR) is scheduled to release September Existing Home Sales on Wednesday, October 23rd at 10 AM ET. The consensus is for 3.89 million SAAR, up from 3.86 million in August. Housing economist Tom Lawler estimates the NAR will report September sales of 3.83 million SAAR.

Wealth Management

OCTOBER 22, 2024

Morningstar took a look at recent thematic fund performance in the U.S. and globally.

Advertisement

Where are top advisors focusing in 2025? AcquireUp’s 2025 Industry Index reveals it all. Based on insights from 200+ financial professionals nationwide, discover why 74% say seminars and referrals deliver the best ROI, how automation is helping advisors scale faster, and why only 8% are tapping into niche marketing (a major growth opportunity!). Whether you're refining your client acquisition strategy or scaling your practice, this report gives you the real-world data, benchmarks, and action ste

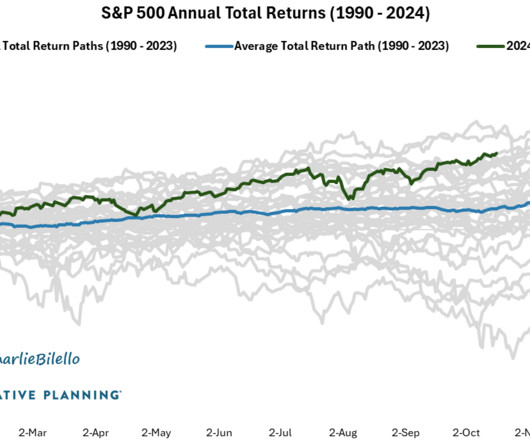

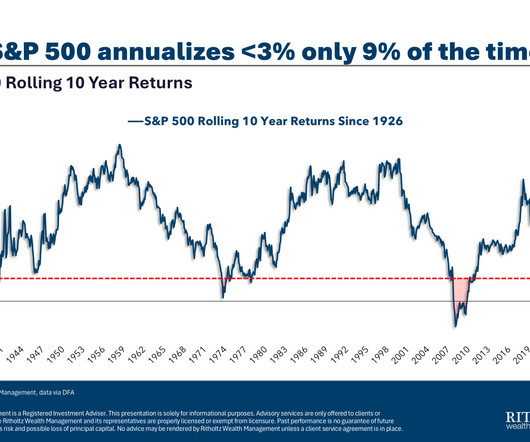

A Wealth of Common Sense

OCTOBER 22, 2024

The U.S. stock market has been on fire of late. But it doesn’t feel like we’ve entered the euphoric phase of investor psychology just yet. In fact, many prognosticators have been lowering expectations. Goldman Sachs put out a research piece that posits the S&P 500 could return just 3% annualized over the next 10 years (just 1% after inflation): These are their baseline assumptions and they offer a range o.

Wealth Management

OCTOBER 22, 2024

Wednesday, November 13, 2024 | 2:00 PM ET

Nerd's Eye View

OCTOBER 22, 2024

Welcome everyone! Welcome to the 408th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Maddi Keegan. Maddi is a Financial Advisor and the Director of Operations of Frazier Financial Advisors, an RIA based in Columbus, Ohio that oversees $860M in assets under management for 650 client households. What's unique about Maddi, though, is that after building a successful solo advisory firm, she then decided to merge her business with Frazier Financial Advisors, a mid-

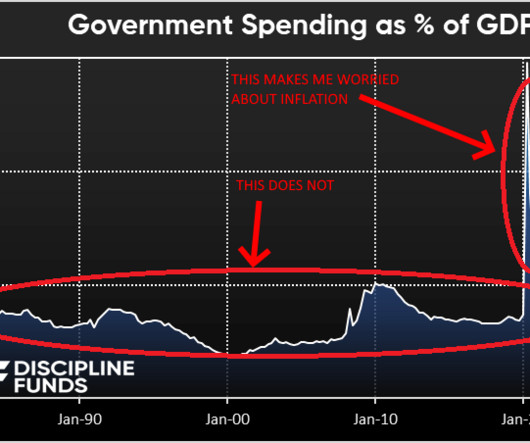

Discipline Funds

OCTOBER 22, 2024

You just have to love the short-term overreactions of Mr. Market. Just two months ago we get a weak employment report and investors are panicked that the Fed is too tight. Then we get a strong employment report in September and investors are panicked that the Fed is too loose. In May the 10 year interest rate was as high as 4.75%. By September it was as low as 3.6%.

Speaker: Claire Grosjean, Global Finance & Operations Executive

Finance teams are drowning in data—but is it actually helping them spend smarter? Without the right approach, excess spending, inefficiencies, and missed opportunities continue to drain profitability. While analytics offers powerful insights, financial intelligence requires more than just numbers—it takes the right blend of automation, strategy, and human expertise.

Million Dollar Round Table (MDRT)

OCTOBER 22, 2024

By Antoinette Tuscano, MDRT senior content specialist The people in our lives, and the quality of those connections, matters. For instance, there are important relationships in your life that can assist with achieving your goals. And if you’re looking to accelerate the success of your critical goals, then put a relationship action plan (RAP) around that goal, said U.S. author and entrepreneur Keith Ferrazzi, in his 2023 MDRT EDGE presentation.

Trade Brains

OCTOBER 22, 2024

Right now, a lesser-known investing theme has started to play out following Prime Minister Narendra Modi’s visit to Russia. Reports suggest that Russia & India are discussing building 6 nuclear power units in India. Indian companies have been participating in the nuclear power segment ever since the growing support for nuclear as a low-carbon energy source sent uranium prices 3x since the end of 2020.

Advisor Perspectives

OCTOBER 22, 2024

The Conference Board Leading Economic Index (LEI) decreased in September to its lowest level since October 2016. The index fell 0.5% from the previous month to 99.7, marking its seventh consecutive monthly decline.

NAIFA Advisor Today

OCTOBER 22, 2024

The National Association of Insurance and Financial Advisors (NAIFA) , which empowers financial professionals and consumers through world-class advocacy, education and differentiation, today announced a strategic partnership with Practice Intel , a data analytics and performance improvement platform to help advisory firms improve the quality of advice they deliver to their clients and drive organic growth in the process.

Speaker: David Worrell, CFO, Author & Speaker

Your financial statements hold powerful insights—but are you truly paying attention? Many finance professionals focus on the income statement while overlooking key signals hidden in the balance sheet and cash flow statement. Understanding these numbers can unlock smarter decision-making, uncover risks, and drive long-term success. Join David Worrell, accomplished CFO, finance expert, and author, for an engaging, nontraditional take on reading financial statements.

Advisor Perspectives

OCTOBER 22, 2024

In this new economy, your prospect is assessing you, the opposite of the way things should be and used to be. The advisory industry is now officially in a trust recession.

Trade Brains

OCTOBER 22, 2024

The ever-changing dynamics of the cement industry are related to Infrastructure spending which is capex driven by the government. This has led to an increase in capacities and acquiring companies to utilize the synergy which is expected. In this article, we will look at Ambuja Cements vs Ultratech Cements which are trying to increase their market share through acquisitions and capex.

Advisor Perspectives

OCTOBER 22, 2024

I often hear my clients talk about the struggles with the next generation and how hard it is to work with them.

Trade Brains

OCTOBER 22, 2024

One of India’s leading non-banking financial companies (NBFCs), known for its robust retail lending, consumer finance, and digital-first approach, witnessed a sharp surge of over 5.8% in its stock price following the announcement of its stellar second-quarter results for the financial year 2025. The company, which specialises in consumer durables financing, personal loans, and SME lending, has maintained its strong market position with a significant increase in assets under management and

Speaker: Erroll Amacker

Automation is transforming finance but without strong financial oversight it can introduce more risk than reward. From missed discrepancies to strained vendor relationships, accounts payable automation needs a human touch to deliver lasting value. This session is your playbook to get automation right. We’ll explore how to balance speed with control, boost decision-making through human-machine collaboration, and unlock ROI with fewer errors, stronger fraud prevention, and smoother operations.

Advisor Perspectives

OCTOBER 22, 2024

I have developed a seven-step framework that has been used countless times to assist advisors looking to build a $1 million, 100-days-off practice, as well as help leaders of seven-figure firms scale their success to new heights.

Trade Brains

OCTOBER 22, 2024

Beverage Company, which is in the production and distribution of a wide range of non-carbonated drinks, carbonated soft drinks, and packaged water which is sold under trademarks and owned by PepsiCo jumped 2 percent in the intraday trading after releasing its Q3FY24 results. Varun Beverages has a market capitalization of Rs. 1,91,997 Crores. Its shares were trading at Rs. 591, a 2.2 percent increase from the previous day’s closing price of Rs. 578.20.

Tobias Financial

OCTOBER 22, 2024

Join us on Thursday, November 14th at 12:30 PM Eastern for our Year-end Tax Planning Webinar. When : Thursday, November 14th at 12:30 PM Eastern Registration : Click here to register. Cost : Complimentary After registering, you will receive a confirmation email with instructions for joining the webinar. We look forward to your attendance.

Trade Brains

OCTOBER 22, 2024

One of India’s leading power stock companies engaged in the generation, transmission, and trading of power has signed a Power Purchase Agreement with Solar Energy Corporation of India Limited for 700 MW Solar Power Projects Stock Movement: With a market capitalization of Rs. 1,15,492.54 crore, the shares of JSW Energy Limited were trading at Rs. 660.80 per equity share, down nearly around 1.12 percent from its previous day’s close price of Rs. 669.80.

Advertisement

Based off SkyStem's popular e-Book, the book of secrets to the month-end close will be revealed in this one-hour webinar. Learn leading practices when it comes to building a strong and sustainable month-end close that has room to grow and evolve. Learn about the power of precise estimates, why reconciliations are critical to closing the books, how and when to automate, and how the chart of accounts play into your close process.

Accounting for Good

OCTOBER 22, 2024

Not For Profit organisations continue to make a significant difference to a large percentage of Australians.

Trade Brains

OCTOBER 22, 2024

This Maharatna PSU Company is the largest electric power transmission company in India. The PGCIL was incorporated in 1989 and it was set up to supply high-voltage direct current, extra-high voltage alternating current transmission lines in focus after receiving LOI from Rajasthan REZ. Stock Movement: Power Grid Corporation of India has a market capitalization of Rs. 2,97,665 Crores.

Random Roger's Retirement Planning

OCTOBER 22, 2024

Nate Geraci of the ETF Store is fond of saying "no one knows nothing" usually in the context of talking about Bitcoin but I think the sentiment also applies to the sentiment around long bonds. Here's a chart from Bespoke Investment Group. There was a pretty wide consensus from long before the FOMC actually made that first rate cut that investors should lock into longer bonds before those rates went down and stayed down.

Trade Brains

OCTOBER 22, 2024

Persistent Systems saw its stock soar by 10% today. The jump came after strong earnings in Q2 of FY25. Their shares hit Rs 5,672 on the BSE during Wednesday’s trading. On the NSE too, the price touched Rs 5,674. The market’s response shows growing investor confidence in the company’s performance. Impact of Result on Share Price Moreover, the company posted impressive growth in its profits.

Advertisement

Like being inches from the end zone, many advisors are frustratingly close to their next level of success. You work hard. You put in the hours. But if your closing rate is stuck or your pipeline feels like a revolving door… something has to change. Most advisors are just one small shift away from dramatically increasing their revenue. The difference?

Let's personalize your content