Personal finance links: a recipe for unhappiness

Abnormal Returns

JANUARY 31, 2024

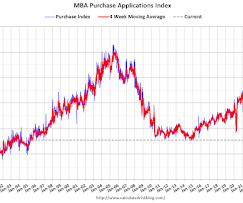

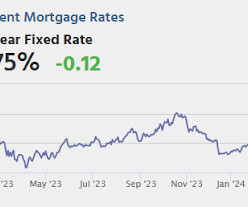

Podcasts Meb Faber talks with Jared Dillian author of "No Worries: How to Live a Stress-Free Financial Life." (mebfaber.com) Dan Haylett talks with Sonya Lutter about addressing 'your money scripts' in retirement. (humansvsretirement.com) Rick Ferri talks real estate investing with Dr. Jim Dahle and John Worth. (bogleheads.podbean.com) Homes Why people prefer owning over renting.

Let's personalize your content