Thursday links: stand alone statements

Abnormal Returns

FEBRUARY 1, 2024

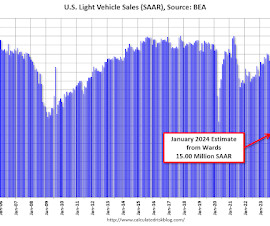

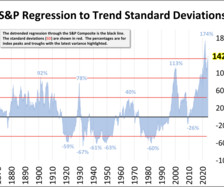

January 2024 How major asset classes performed in January 2024. (capitalspectator.com) The S&P 500 was in positive territory for the month, in contrast with small and mid caps. (on.spdji.com) Strategy Overconfidence is a killer for investors. (collabfund.com) Four steps to build a no-fuss portfolio including eliminating redundant accounts. (morningstar.com) Bitcoin Will spot Bitcoin ETFs follow the path of gold ETFs?

Let's personalize your content