Wednesday links: confounded economists

Abnormal Returns

DECEMBER 27, 2023

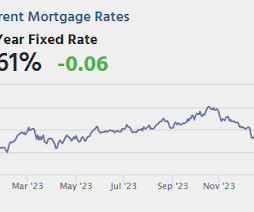

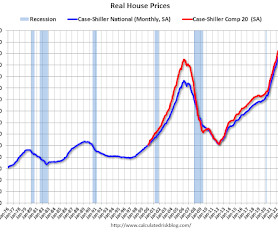

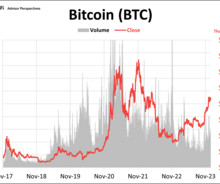

Markets Every yield curve steepening is different. (integratinginvestor.com) What panic looks like in real-time. (investmenttalk.co) Strategy Forecast all you want, but unexpected stuff will happen in 2024. (awealthofcommonsense.com) Michael reviews his ten predictions from 2023 including Bitcoin prices. (theirrelevantinvestor.com) Banks JP Morgan Chase ($JPM) is going earn nearly 20% of U.S. bank profits in 2023.

Let's personalize your content