Press Pause

The Big Picture

MAY 3, 2023

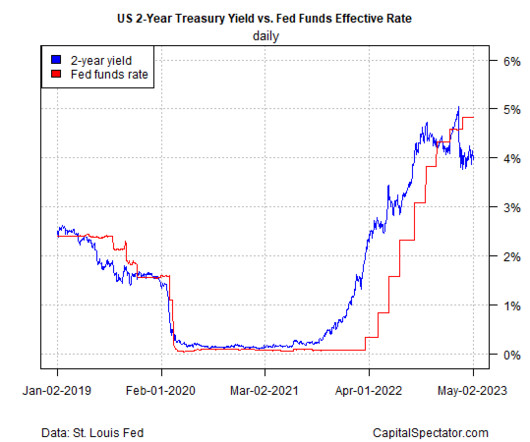

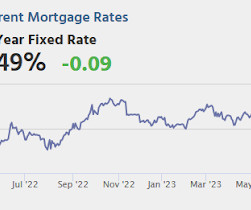

At least they told us what they were going to do. As much as critics of the Federal Reserve have been up in arms over the fastest rate hiking cycle in modern history, no one can claim it to be a surprise. Jerome Powell & Co. have continually warned that they are aggressively fighting inflation with a 5% target. They said it in Fed minutes, they said it in pressers, they said it in speeches; we just took them figuratively, not literally.

Let's personalize your content