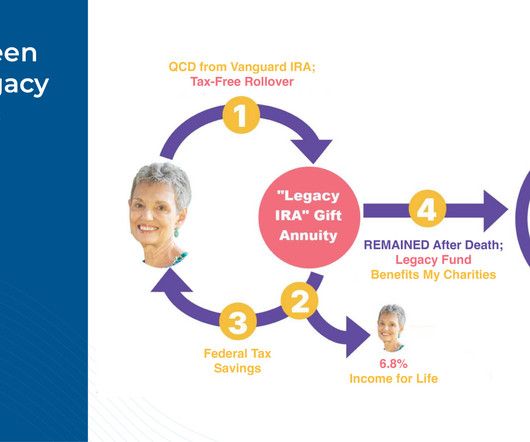

“Legacy IRA” Rollover To A Charitable Gift Annuity: Using This New Tax-Advantaged Opportunity To Help Clients Achieve Charitable And Retirement Goals

Nerd's Eye View

AUGUST 23, 2023

Charitable Gift Annuities (CGAs) have long been a popular way for individuals with charitable intentions to plan their legacies. By contributing a lump sum to a charity in exchange for fixed recurring payments for life (with any leftover funds after the donor's death going to the charity), the individual can ensure that their funds are directed towards a purpose that aligns with their values, while also retaining a steady source of income for the rest of their life.

Let's personalize your content