Wednesday links: where the world is going

Abnormal Returns

MARCH 27, 2024

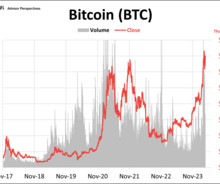

Markets What will it take for small caps to outperform? (ft.com) Apple ($AAPL) is at 28-month lows vs. the S&P 500. (allstarcharts.com) Crypto Why the FTX exchange did not get rebooted. (wsj.com) On the prospect for spot Ethereum ETF. (blockworks.co) Finance There's no alpha left in private equity. (linkedin.com) A list of the highest earning hedge fund managers of 2023.

Let's personalize your content