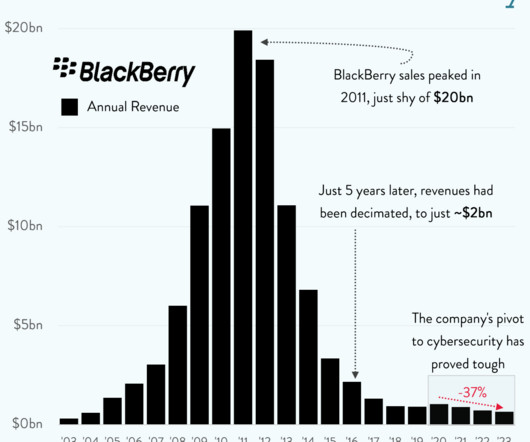

Forget the iPhone: BlackBerry is still the one to beat

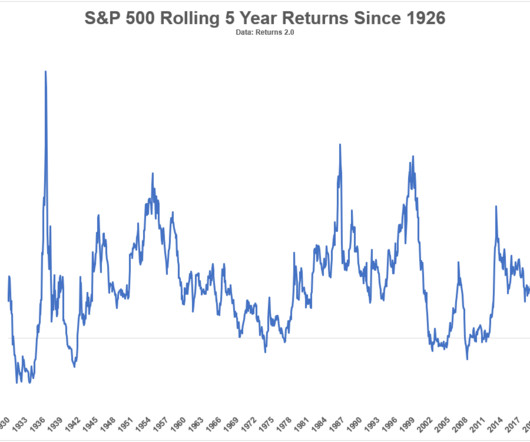

The Big Picture

AUGUST 24, 2023

How little do we know about the future? A great way to figure that out is to look to our past, to see what we previously thought about what the future will hold. To wit: 26 years ago, the image above came from the cover story of Fortune magazine: “There’s a lot of buzz in the smartphone business lately, with Apple’s (AAPL) iPhone turning the mobile world upside down and Nokia’s (NOK) upcoming phone announcement providing a new challenge.

Let's personalize your content