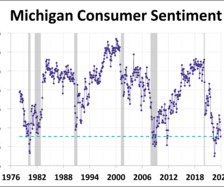

Friday links: how Americans feel

Abnormal Returns

NOVEMBER 10, 2023

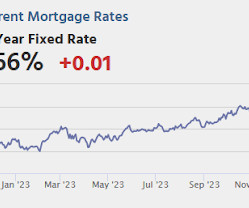

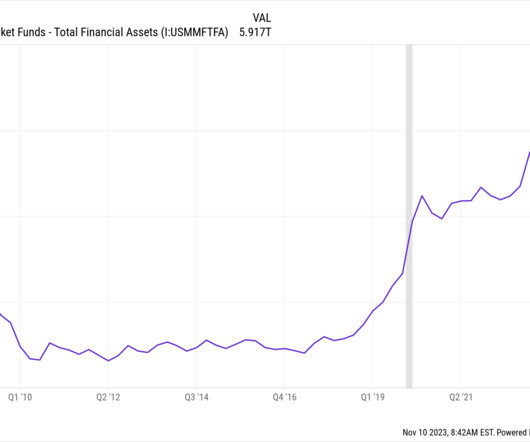

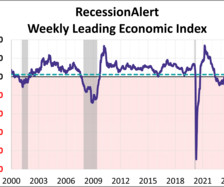

Strategy The 40 of the 60/40 portfolio is finally earning people something. (awealthofcommonsense.com) There's still no sign of a turn in the trend favoring U.S. vs. international equities. (allstarcharts.com) The case for bonds. (blogs.cfainstitute.org) Energy Solar panel manufacturing is finally on the rise in the U.S. (nytimes.com) Why the cancellation of the NuScale, small modular reactor, project is such a bummer.

Let's personalize your content