Monday links: unproductive entrepreneurship

Abnormal Returns

NOVEMBER 20, 2023

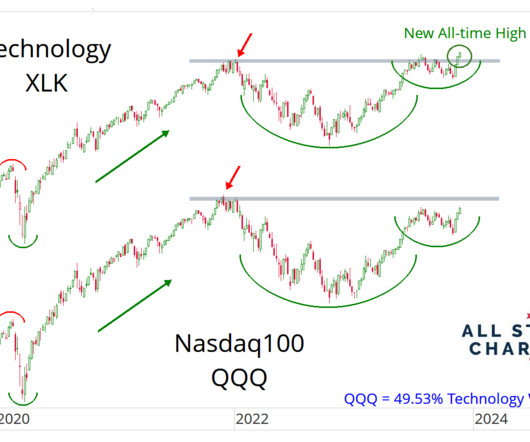

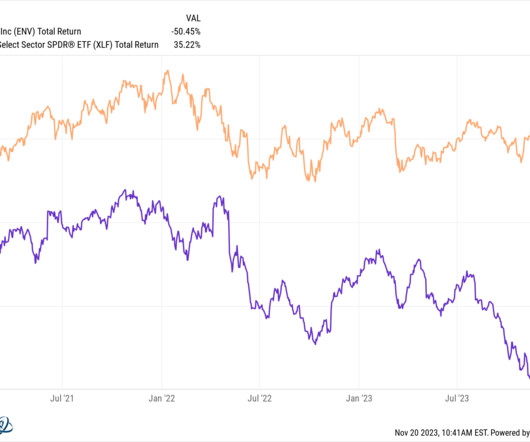

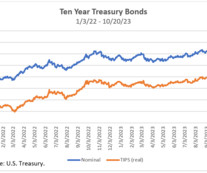

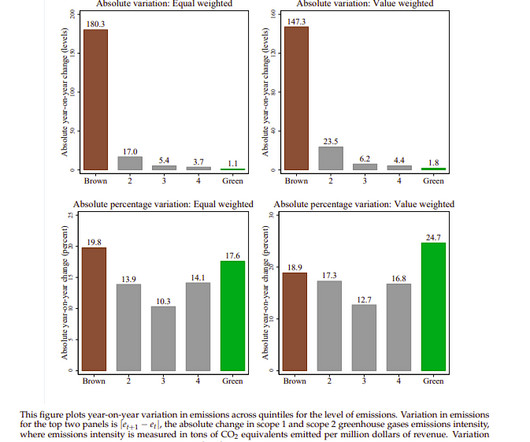

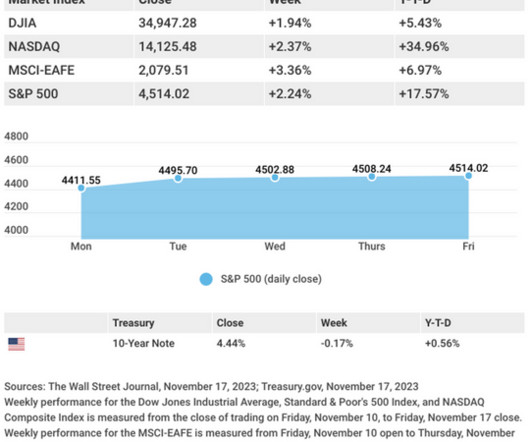

Markets The U.S. stock market hasn't made a new high in nearly 500 trading days. (awealthofcommonsense.com) How this yield curve steepening is different. (integratinginvestor.com) Strategy ESG or not, people are going to invest according to their values. (ritholtz.com) On the downside of focusing on high dividend yields. (insights.finominal.com) Crypto Do futures-backed Bitcoin ETFs have a future?

Let's personalize your content