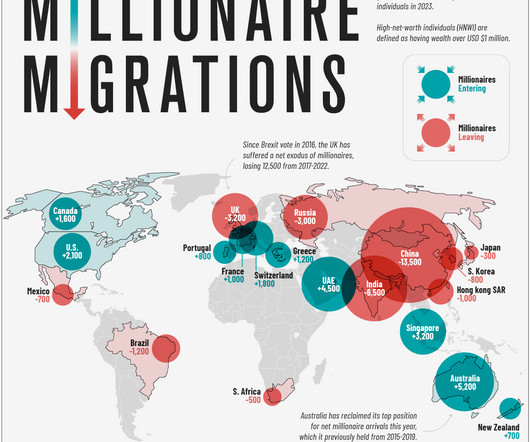

Where’s Everyone Going?

The Big Picture

SEPTEMBER 27, 2023

Mapped: The Migration of the World’s Millionaires in 2023 Source: Visual Capitalist The post Where’s Everyone Going? appeared first on The Big Picture.

The Big Picture

SEPTEMBER 27, 2023

Mapped: The Migration of the World’s Millionaires in 2023 Source: Visual Capitalist The post Where’s Everyone Going? appeared first on The Big Picture.

Abnormal Returns

SEPTEMBER 27, 2023

Podcasts Joe Weisenthal and Tracy Alloway talk with Morgan Housel about how to think about money. (podcasts.apple.com) Christine Benz and Jeff Ptak talk with Michael Santoli about the state of the stock market and economy. (morningstar.com) Home ownership House ownership isn't for everyone. (awealthofcommonsense.com) Why you should keep track of the tax basis of your house.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The Reformed Broker

SEPTEMBER 27, 2023

Stocks stage late-day comeback amid September slump from CNBC. The post Clips From Today’s Closing Bell appeared first on The Reformed Broker.

The Big Picture

SEPTEMBER 27, 2023

My mid-week morning train reads: • 24 Things I Believe About Investing : Simple beats complex, timing matters less than your holding period, and a good strategy you can stick with is vastly superior to a great one you can’t. ( A Wealth of Common Sense ) • Even a Booming Economy Can’t Save Atlanta’s Office Market : Sunbelt city offers warning to others hoping to fill up office towers. ( Wall Street Journal ) • Private Equity’s Slow Carnage Unleashes a Wave of Zombies : A historic shakeup is thre

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Trade Brains

SEPTEMBER 27, 2023

Indian Railways is on a continuous growth path and ranks as the world’s 4th biggest railway network, along with this, the Vandhe Bharat Express is a game-changer for Indian Railways as it aims to modernise Indian Railways by improving connectivity, security, sanitation and speed. But it doesn’t stop there! These trains are not just fuel efficient but also help reduce carbon emissions, making them eco-friendly and promoting sustainable transportation.

Financial Advisor Source brings together the best content for financial advisor professionals from the widest variety of industry thought leaders.

The Irrelevant Investor

SEPTEMBER 27, 2023

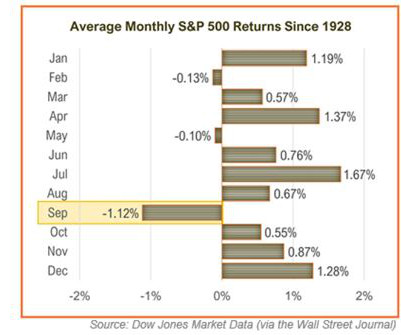

September has a long history of disappointing investors. Going back to 1928, it has by far delivered the worst monthly return for investors. And true to form, it’s done so again, with the S&P 500 down nearly 6% on the month. As you can see from the chart below, seasonal weakness tends to occur in the back half of the month, and wouldn’t you know it, that’s what happened this time around.

Wealth Management

SEPTEMBER 27, 2023

Patrick “Pat” Ricketts and Mindy Helfrich of Vintage Financial Group have more than four decades of total industry experience and have worked together for more than 10 years.

Carson Wealth

SEPTEMBER 27, 2023

By Matt Lewis, CLTC, Vice President, Insurance Life insurance is designed to provide for your loved ones after your death, giving you peace of mind that their financial needs will be met without your income. But life insurance can benefit your financial planning in many other ways. For individuals, a permanent life insurance plan can play a key role in estate planning by helping reduce estate taxes.

Wealth Management

SEPTEMBER 27, 2023

Wealth Enhancement Group SVP Paul Brahim is FPA's president-elect in 2024. He'll succeed Claudia Cypher Kane, who starts her term as president Jan. 1.

Advertisement

As we step into 2024, the lending landscape evolves rapidly with technology, regulations, and market dynamics driving change. For banks and financial institutions to stay competitive and meet the evolving needs of their customers, these drivers must be understood and engaged with. Lenders can anticipate significant transformation fueled by technological advancements, regulatory shifts, and changing consumer behaviors.

Advisor Perspectives

SEPTEMBER 27, 2023

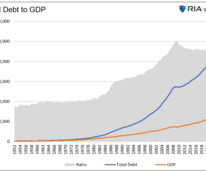

A financial crisis, following the 5.50% hike in Fed funds and similar increases in all bond yields, is virtually inevitable.

Wealth Management

SEPTEMBER 27, 2023

The agreement to buy GM Advisory Group will add more than $6 billion in client assets to the NFP-owned Wealthspire Advisors RIA.

A Wealth of Common Sense

SEPTEMBER 27, 2023

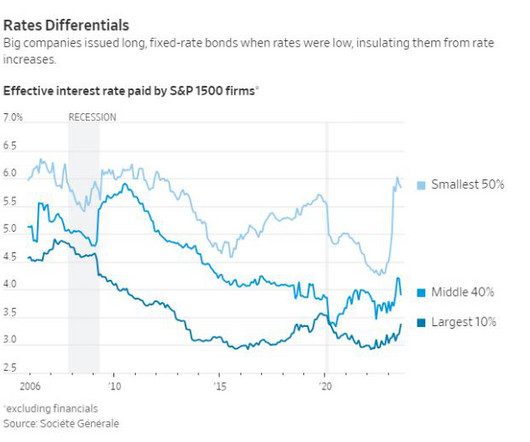

Today’s Animal Spirits is brought to you by YCharts: See here for YCharts latest KPI function, and here for 20% off your initial subscription for new subscribers! On today’s show, we discuss: Are we heading for a recession? Rising rates make big companies even richer S&P US Scorecard You might be paying too much for that index fund Dead NFTs: The evolving landscape of the NFT market House poor is b.

Wealth Management

SEPTEMBER 27, 2023

The bottom line isn’t to predict what will be audited, but to understand that these days, anything could be audited.

Speaker: Joe Buhrmann, MBA, CFP®, CLU®, ChFC® Senior Financial Planning Practice Management Consultant eMoney Advisor

During an era of evolving consumer preferences, the banking sector is undergoing a profound shift. As customers continue to broaden their perspectives, banking professionals must support their customers' financial wellness by providing holistic financial advice that aligns with individual goals and circumstances. Without adapting, financial institutions will find that loyalty may crumble amid uncertainty.

Advisor Perspectives

SEPTEMBER 27, 2023

Too many industry “experts” make value out to be much more elusive and complicated than it is.

Wealth Management

SEPTEMBER 27, 2023

Oil, gas and energy ETFs posted the best returns over the last three years.

Advisor Perspectives

SEPTEMBER 27, 2023

China’s goal of self-reliance will certainly rely on innovation. Right now, the second-largest economy sits firmly atop the list of the World Intellectual Property Organization (WIPO) when it comes to innovation on a global scale.

Wealth Management

SEPTEMBER 27, 2023

If found guilty, they may be liable for up to $1 billion in back taxes and fines.

Advertisement

Digital platforms can provide you with plenty of solutions, yet many are still intimidated by them. It's time to end that worry and embrace what could make a major difference for your bank. Understanding how they work and how to best utilize them for your banks is key toward success. In this article, Biz2X breaks down all things digital platforms, including the many advantages of embracing them.

Advisor Perspectives

SEPTEMBER 27, 2023

Successful marketing is not exclusive to extroverted advisors. When introverts leverage their unique strengths, they will find a different path to achieving success.

Wealth Management

SEPTEMBER 27, 2023

Son of heiress to Texaco fortune may be liable for penalties for willful nondisclosures.

Advisor Perspectives

SEPTEMBER 27, 2023

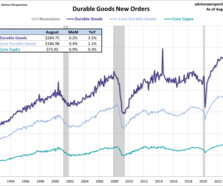

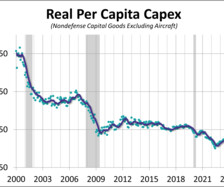

New orders for manufactured durable goods unexpectedly rose in August, coming in at $284.75B. This is a 0.2% increase from the previous month and is better than the expected 0.5% decline. The series is up 3.5% year-over-year (YoY). If we exclude transportation, "core" durable goods were up 0.4% from the previous month and up 1.1% from one year ago.

Wealth Management

SEPTEMBER 27, 2023

A helpful and powerful tool for charitably inclined clients with complex assets.

Advertisement

All accounting teams know what it is like to dread the inevitable month-end scaries. If there was a way to feel less burdened and maybe even a little enthusiastic to work on your month-end close and reconciliation process, would you do it? No, don't answer that, of course you would! Automate your month-end close process by up to 40% with SkyStem's ART and see how much more alive you feel!

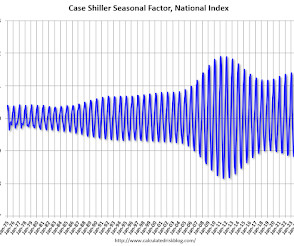

Calculated Risk

SEPTEMBER 27, 2023

Two key points: 1) There is a clear seasonal pattern for house prices. 2) The surge in distressed sales during the housing bust distorted the seasonal pattern. This was because distressed sales (at lower price points) happened at a steady rate all year, while regular sales followed the normal seasonal pattern. This made for larger swings in the seasonal factor during the housing bust.

Wealth Management

SEPTEMBER 27, 2023

One of the many benefits of having a private foundation is that it lives in perpetuity, creating numerous opportunities for advisory professionals to offer support and guidance to their HNW clients at key intersections along the journey.

Calculated Risk

SEPTEMBER 27, 2023

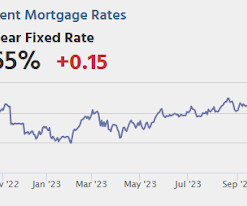

Note: Mortgage rates are from MortgageNewsDaily.com and are for top tier scenarios. Thursday: • At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 206 thousand initial claims, up from 201 thousand last week. • Also at 8:30 AM, Gross Domestic Product, 2nd Quarter 2023 (Third Estimate), and Corporate Profits (Revised) The consensus is that real GDP increased 2.2% annualized in Q2, up from the second estimate of 2.1%.

Wealth Management

SEPTEMBER 27, 2023

Open, honest and candid discussions about the latest news in the RPA industry.

Advertisement

Creating a winning digital lending experience requires plenty of focus on the needs of customers and more. Biz2X Chief Product Officer Aaron Traub covers everything from how to create such an experience, areas to hone in on, pitfalls to avoid, and plenty more in this insightful article. Discover how to utilize new technology without alienating existing customers, what to emphasize when working on your platform, and how to utilize the data at your disposal while not becoming overly reliant on it.

Meb Faber Research

SEPTEMBER 27, 2023

Episode #501: John Davi, Astoria Advisors – Macro+Quant, Inflation & Global Diversification Guest: John Davi is the CEO and CIO of Astoria Portfolio Advisors, which provides ETF managed portfolios and sub-advisory services. Date Recorded: 9/14/2023 | Run-Time: 55:34 Summary: In today’s episode, John walks through his macro plus quant approach to the markets.

Trade Brains

SEPTEMBER 27, 2023

Large Cap Stock With High FII Holdings : Large-cap stocks are Companies with a sizeable reputation and a massive investor base. These Companies have been in the markets for decades together. They would have survived any economic adversity affecting their business, managing to stay profitable. While Some, in spite of being loss-makers can still be market leaders in their industry.

Advisor Perspectives

SEPTEMBER 27, 2023

The Census Bureau has posted its advance report on new orders for durable goods for August. This series dates from 1992 and is not adjusted for either population growth or inflation. Let's review durable goods data with those two adjustments.

Let's personalize your content