2% Inflation Target is Silly

The Big Picture

JULY 26, 2023

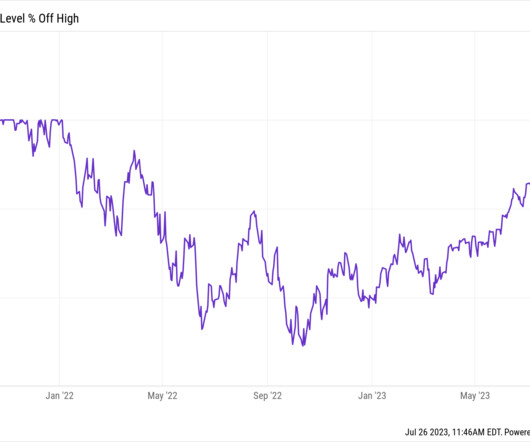

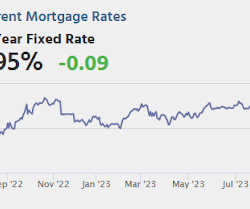

One of the more foolish arguments 1 that seem to be emanating from the Fed about their intention to raise rates another quarter point today: The 2% inflation target that has been in place pretty much the entire post-financial crisis era. There is no empirical evidence showing 2% is the optimal long-run inflation target, given the Fed’s dual mandate of price stability and maximum employment.

Let's personalize your content