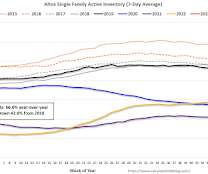

Housing January 16th Weekly Update: Inventory Increased 0.3% Week-over-week

Calculated Risk

JANUARY 16, 2023

Altos reports inventory was up 0.3% week-over-week. Usually inventory bottoms in February; last year, in 2022, inventory bottomed in early March. It is possible that inventory has already bottomed for the year! Here are the same week inventory changes for the last five years: 2023: +1.3K 2022: -8.4K 2021: -22.9K 2020: -25.8K 2019: -2.3K Click on graph for larger image.

Let's personalize your content