At the Money: How To Know When The Fed Will Cut

The Big Picture

MARCH 13, 2024

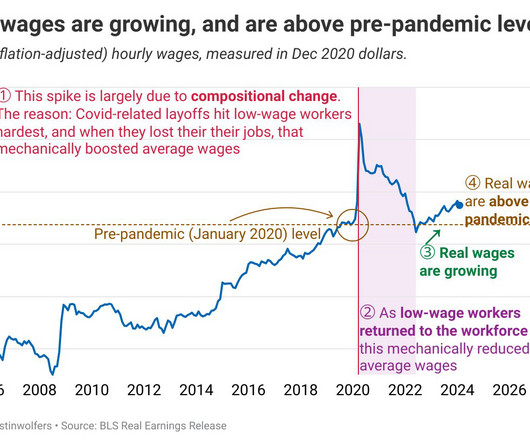

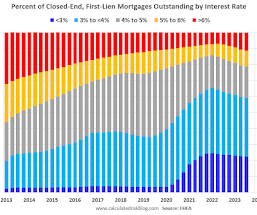

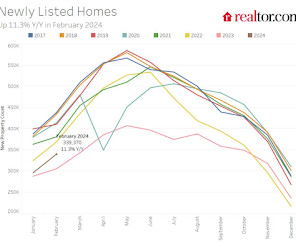

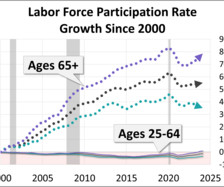

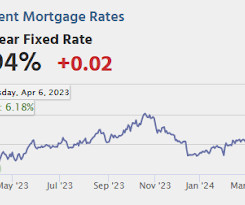

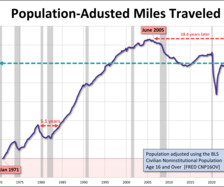

At the Money: How To Know When The Fed Will Cut with Jim Bianco (March 13, 2024) Markets have been waiting for the Federal Reserve to begin cutting rates for over a year. What data should investors be following for insight into when they will begin? Jim Bianco discusses initial unemployment claims data and wage gain to identify when the Fed will start lowering rates.

Let's personalize your content