Will AI Save the World?

The Reformed Broker

JUNE 9, 2023

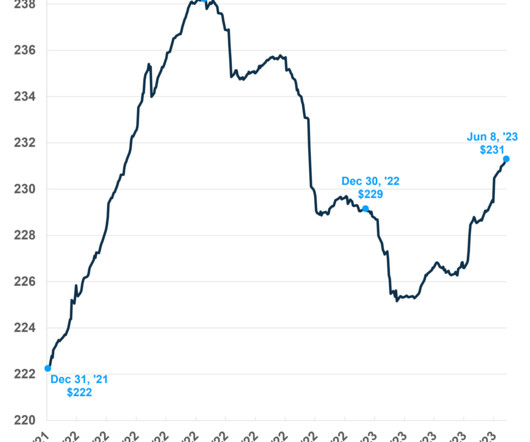

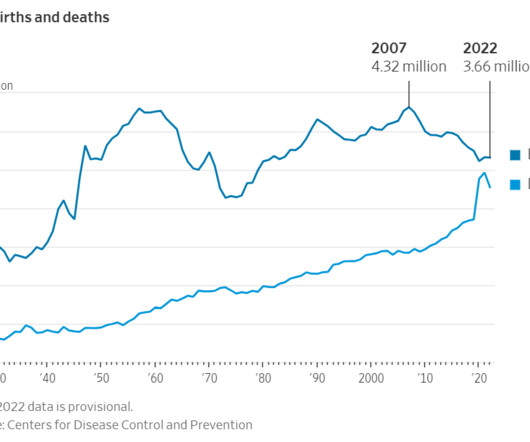

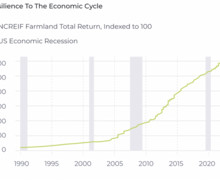

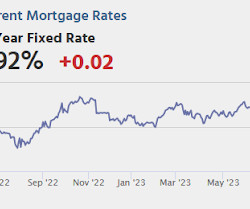

Welcome to the latest episode of The Compound & Friends. This week, Michael Batnick, Jill Schlesinger, and Downtown Josh Brown discuss whether or not the bear market is over, the chances of Jamie Dimon running for president, Apple’s WWDC product unveil, the accredited investor rule, Artificial Intelligence, the state of the economy, and much more!

Let's personalize your content