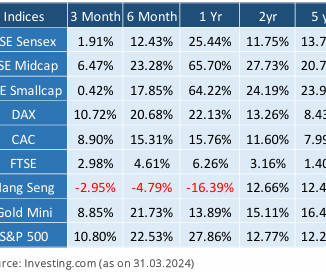

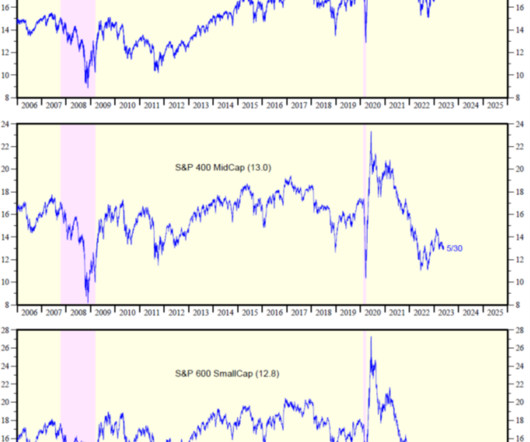

1st Quarter 2024 Economic And Market Outlook: Potential Increased Volatility, Threats To Economic Growth, And Equity Markets

Nerd's Eye View

APRIL 3, 2024

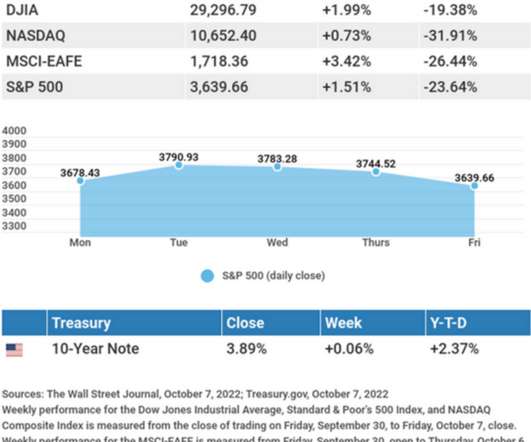

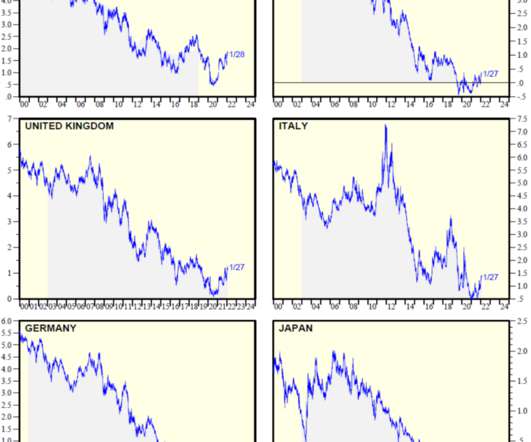

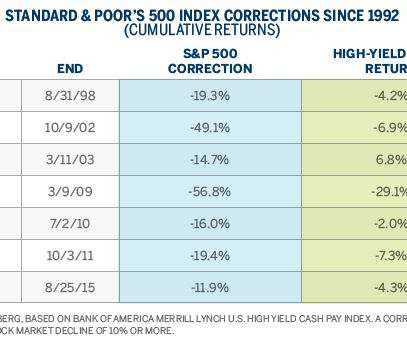

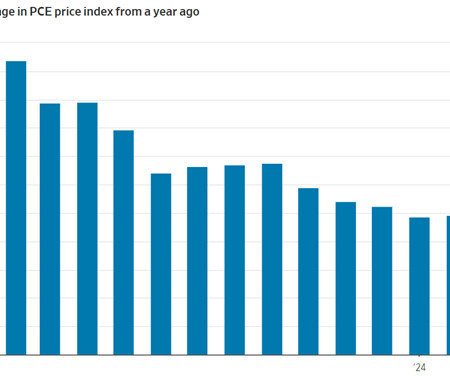

With a plethora of interdependent and ever-changing parts, gaining a clear (or even not-terribly-fuzzy) understanding of where the economy stands at any given moment is a daunting task, to say the least. Meanwhile, a smorgasbord of potential risks threatens economic growth's "soft landing" narrative.

Let's personalize your content