Charles Schwab Expands 24-Hour Trading to All Its Retail Clients

Wealth Management

FEBRUARY 12, 2025

Schwabs retail clients will be able to trade a wider range of securities 24 hours, five days a week.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

FEBRUARY 12, 2025

Schwabs retail clients will be able to trade a wider range of securities 24 hours, five days a week.

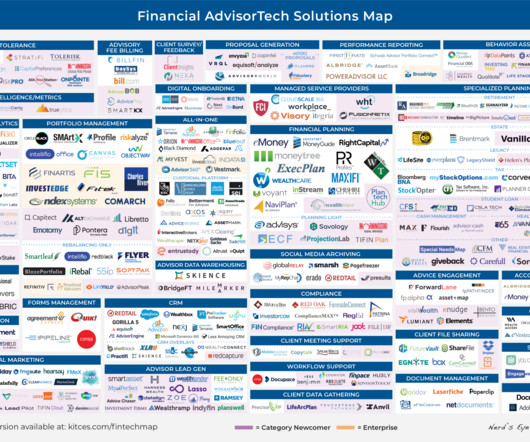

Nerd's Eye View

NOVEMBER 22, 2024

Further, amidst grumbling from some firms, incoming CEO Rick Wurster reiterated a pledge that Schwab (which offers its own direct wealth management services) will not seek to compete for clients with RIAs on its platform, seeing opportunities to pursue prospective clients currently unserved by either group.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How To Overcome Change Fatigue In Finance With Neuroscience-Backed Strategies

Protect What Matters: Rethinking Finance Ops In A Digital World

Your Accounting Expertise Will Only Get You So Far: What Really Matters

Wealth Management

JUNE 26, 2024

is expanding further into private-markets investing, striking a new partnership to include the assets alongside traditional ETFs and mutual funds in model portfolios pitched to wealthy US retail clients. (Bloomberg) -- BlackRock Inc. The firm will w

Nerd's Eye View

JANUARY 31, 2023

What's unique about Ali, though, is how she transitioned from a retail brokerage firm where she served nearly 400 clients (and was still responsible for business development to get more of them), to a multi-family office serving clients through specialized client relationship teams that keep advisor capacity to no more than 10 clients per advisor at (..)

Wealth Management

OCTOBER 17, 2022

According to the commission, Keith Springer and his firm used “deceptive marketing” via ads and his radio show to attract investors, many of whom were retirees.

Wealth Management

JUNE 25, 2024

A new report from Cerulli & Associates finds the retail financial advisor channel has been the biggest growth driver behind ETFs.

Nerd's Eye View

NOVEMBER 12, 2024

Larry is the Chairman of Measured Risk Portfolios, an RIA based in San Diego, California, that oversees $350 million in assets under management for a combination of internal retail clients and external financial advisor clients.

Wealth Management

SEPTEMBER 5, 2024

The acquisition of Archer will help BNY Mellon handle the infrastructure and distribution of managed accounts to financial advisors and their clients.

Nerd's Eye View

DECEMBER 2, 2024

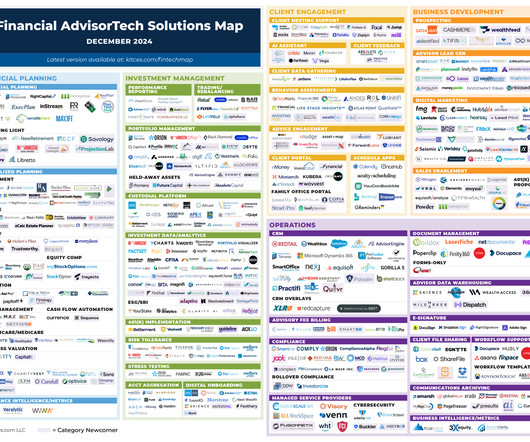

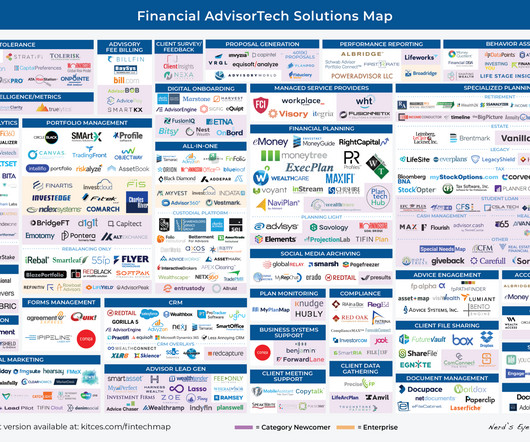

Welcome to the December 2024 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Wealth Management

FEBRUARY 8, 2024

Rowe is in the “early stages” of bringing a private credit fund, dubbed OCREDIT, that it started in October to wealth management clients.

Wealth Management

AUGUST 14, 2023

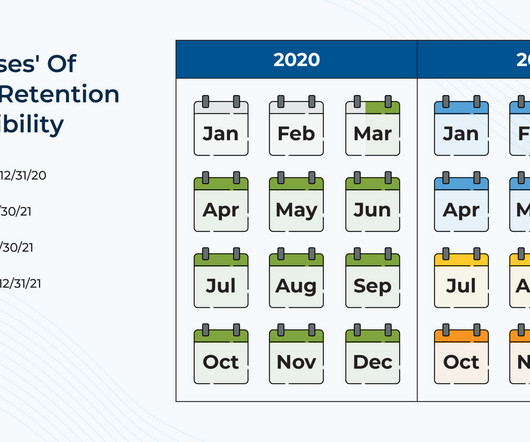

Schwab’s attrition amounts to about 4% of Ameritrade revenue prior to the deal, or around 1% of combined total client assets as of the end of last year.

Wealth Management

JULY 22, 2024

While many in the financial advice business have for years focused on retail clients, some firms are finding that pensions and foundations can pay off in a major way.

Nerd's Eye View

AUGUST 22, 2022

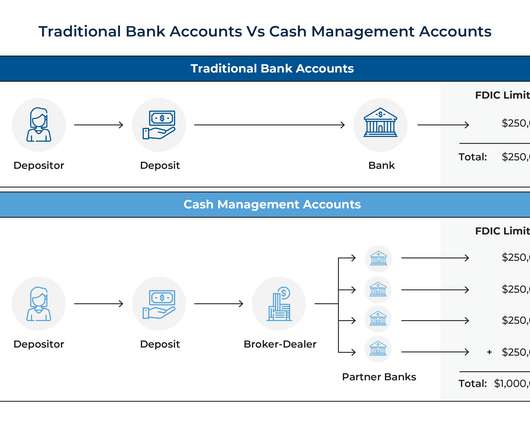

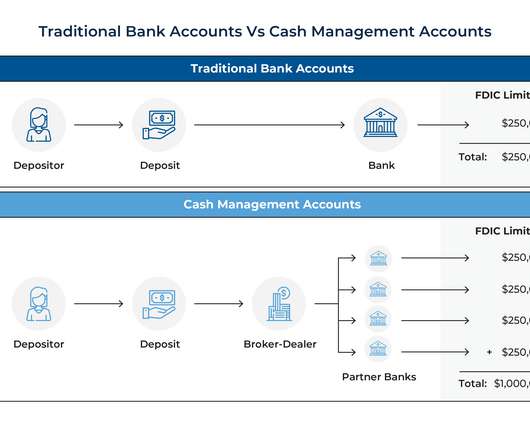

However, despite the impact that cash may have on a person's mindset, advisors have traditionally spent little time advising clients on what to do with their cash - except simply to tell them not to hold too much for risk of losing value to inflation. Read More.

Nerd's Eye View

AUGUST 22, 2022

However, despite the impact that cash may have on a person's mindset, advisors have traditionally spent little time advising clients on what to do with their cash - except simply to tell them not to hold too much for risk of losing value to inflation. Read More.

Wealth Management

DECEMBER 11, 2023

In a recent report, the SEC Investor Advocate suggested the commission "temporarily" stop RIAs from including mandatory arbitration clauses in contracts, arguing they could "mislead retail clients into not exercising their legal rights."

Wealth Management

JULY 26, 2022

Advisors say single-stock ETFs are more appropriate for short-term institutional traders who understand the inherent risks, not for retail clients.

Nerd's Eye View

NOVEMBER 15, 2023

As a result of this attention, advisors are seeing an uptick in questions from their clients – and may have questions about their own businesses – regarding whether or not the ERC is really legitimate, who can actually claim it, and whether it's worth pursuing either way.

Nerd's Eye View

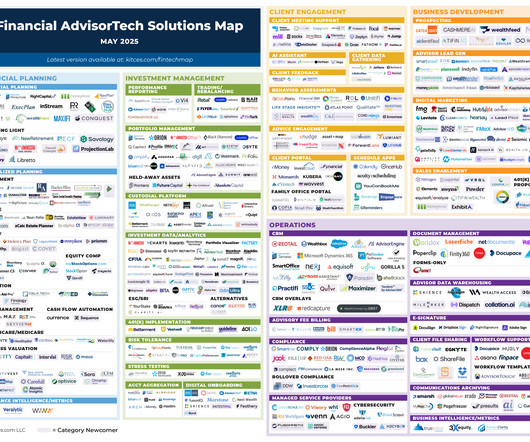

MAY 5, 2025

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including: Charles Schwab has taken a minority stake in estate planning platform Wealth.com as it seeks to offer estate document preparation to its retail investor clients – which on the one hand gives Schwab a value-add that could keep (..)

Abnormal Returns

AUGUST 12, 2024

riabiz.com) Altruist Altruist is shifting more clients onto its own custodian platform. kitces.com) Advisers Why private equity is going after retail investors: fees, high fees. kindnessfp.com) How to think about clients who have an inability to spend money they clearly have. financial-planning.com)

Wealth Management

SEPTEMBER 6, 2022

Asset managers and technology firms are luring retail advisors into alts with easier access and promises of diversification and enhanced returns. Here's what advisors themselves think about broadening their client portfolios.

Abnormal Returns

FEBRUARY 26, 2024

riabiz.com) Alts How to talk to your clients about alternative investments. morningstar.com) Alts managers are gearing up to get in front of retail investors. (kitces.com) The biz How Altruist has gained ground in the custody space. riaintel.com) How XYPN's new corporate RIA, Sapphire, will roll out.

Nerd's Eye View

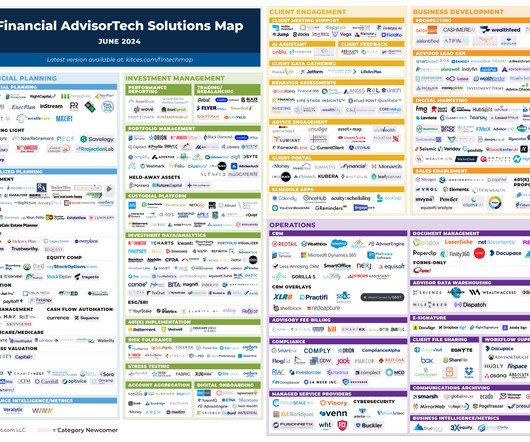

JUNE 3, 2024

This month's edition kicks off with the news that 'startup' custodian Altruist has completed a $169 million fundraising round as it continues to rebuild the RIA custodial tech stack layer-by-layer while positioning itself as the biggest RIA custodian built from scratch and solely for advisors – which, while making it the clear #3 custodian behind (..)

Nerd's Eye View

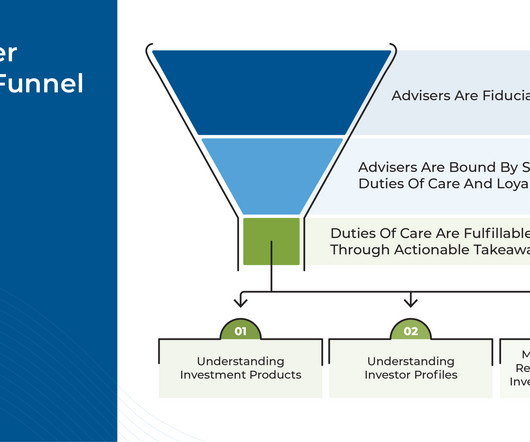

OCTOBER 25, 2023

There is a general understanding that investment advisers have a fiduciary relationship with their clients – in other words, that they are required to act in the client's best interests. These 3 components in practice make up a core part of the adviser's fiduciary duty to their clients.

Nerd's Eye View

APRIL 3, 2023

million in seed funding to support its growth as it builds out its "end-to-end" financial planning and advice engagement platform (but will it be able to replace, rather than augment, advisors' existing financial planning software?)

The Big Picture

JULY 8, 2023

New York Times ) • Walmart Is Quietly Growing Into an E-Retail Tech Titan. The world’s biggest retailer stumbled in the early innings of the e-commerce revolution. trillion dollar in client assets. Others, like Taylor Swift, escaped. ( Now that Walmart has found its footing, it’s poised for big profits. The Stock Is a Buy.

The Big Picture

OCTOBER 15, 2022

in client funds. Retail Gangster: The Insane, Real-Life Story of Crazy Eddie by Gary Weiss. Be sure to check out our Masters in Business next week with Marta Norton, Chief Investment Officer of Morningstar Investment Management. The firm manages directly or advises on $249.4B Outcome-Based Strategies for Morningstar.

Nerd's Eye View

MAY 7, 2024

Hannah is a partner and financial advisor at Lomanto Provost Financial Advisors, a hybrid advisory firm based in Plattsburgh, New York, that oversees approximately $150 million in assets under management for about 380 client households.

Wealth Management

APRIL 25, 2023

The income fund will be distributed through Ares Wealth Management Solutions, the parent’s retail business, and sold through registered investment advisers and financial advisors in the US.

Wealth Management

APRIL 15, 2025

Charles Schwab announced that Schwab Alternative Investments Select, for retail clients with more than $5 million in household assets. Blackstone, Vanguard and Wellington Management announced a partnership to build multiasset portfolios with public and private assets.

Nerd's Eye View

MAY 1, 2023

This month's edition kicks off with the news that robo-advisor Betterment entered into a $9M settlement with the SEC for misrepresenting its tax-loss harvesting practices in its client agreements and marketing materials compared with its actual practices (e.g.,

Nerd's Eye View

DECEMBER 9, 2022

Recruitment has become the top concern for RIAs, according to a Charles Schwab survey, outpacing client acquisition through referrals and other priorities for the first time in the history of the study. A four-step process that advisors can use to help clients who tend to overspend.

Nerd's Eye View

OCTOBER 24, 2022

The advisory firm is the front end of the client relationship, but it entrusts client assets, and key aspects of their service, to a custodian that safeguards the money and provides the underlying platform. This optionality can give fee-conscious advisors (and their clients) the ability to choose what makes the most sense for them.

The Big Picture

SEPTEMBER 19, 2022

How people behave around financial decisions is important; what cognitive issues affect their thought process helps me give better advise to clients; last, how economic behavior impacts the markets and the economy affects us all. This organization primarily operates in the Watches business / industry within the Miscellaneous Retail sector.

Trade Brains

AUGUST 17, 2024

List of Biggest Stockbrokers in India 2024: In this article, we are going to look at the 15 Biggest Stockbrokers in India based on their total number of unique active clients. And this leads to a lot of trouble for their current clients. There are over 4900 stockbrokers in India registered with SEBI and different stock exchanges.

The Big Picture

NOVEMBER 26, 2024

His firm runs over $10 billion in client crypto assets. And find the entire musical playlist of At the Money on Spotify Responsible Crypto Investing Matt Hougan How should retail investors responsibly think about crypto? To help us unpack all of this and what it means for your portfolio, let’s bring in Matt Hogan.

Abnormal Returns

OCTOBER 11, 2022

Retail Kris Abdelmessih, "Options trading is high margin for the brokerage. A mirror of what it looks like for the client." moontowermeta.com) Are retail investors to blame for stock market seasonality? papers.ssrn.com) Behavior More information makes us overconfident.

Nerd's Eye View

MAY 15, 2024

In practice, the DoL's Final Rule means that financial advisers who advise clients about rolling over assets from an employee retirement account like a 401(k) plan into an IRA are now subject to ERISA fiduciary obligations.

Fortune Financial

APRIL 1, 2025

For example, in 2023, we discussed how an older car fleet would provide a long tailwind for auto parts retailers. Both the author and clients of Fortune Financial Advisors, LLC, own shares of Carrier. More recently, we discussed the opportunity present in our nation’s old housing stock.

Abnormal Returns

APRIL 24, 2023

investmentnews.com) Charles Schwab ($SCHW) is rapidly transitioning retail TDA accounts. riaintel.com) How the 'curse of mastery' could be losing you clients. (investmentnews.com) Annuities are coming to a 401(k) plan near you. wsj.com) The biz The challenges of growth: why RIA M&A is likely to continue.

Trade Brains

JUNE 14, 2025

His Portfolio choices are closely tracked by retail and institutional investors alike. The company provides services to a broad spectrum of corporate clients in sectors like banking, finance, technology, healthcare, and many more. Here are the Ashish Kacholia stocks with 5-year Net profit CAGR up to 85%; 1.

The Big Picture

JULY 20, 2023

My obvious bias is that my advisory firm charges clients to create financial plans and manage their assets. It is the advisor’s job to prevent clients from engaging in the kind of bad investment behavior that drawdowns often cause; I cannot see how trading that for >30% of the upside makes any sense. Chart after the jump ).

The Irrelevant Investor

JANUARY 24, 2023

Today’s Animal Spirits is brought to you by YCharts: Enter your information here to get 20% off YCharts (new clients only) On today’s show, we discuss: The narrative vortex December 2022 retail sales Auto market weekly summary: January 13 Tesla’s price cuts are roiling the car market Over 5M new US startups show Covid-era boom has legs Google (..)

Trade Brains

JUNE 17, 2025

Here is the List of stocks to watch out for: Aditya Birla Fashion and Retail Ltd Aditya Birla Fashion and Retail Ltd (ABFRL) is a leading Indian fashion retailer with a wide portfolio of brands, including Pantaloons, Louis Philippe, Van Heusen, Allen Solly, and Peter England.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content