CFP Board’s Fee Increase For Workforce Development: More Advisors Or Just More Sales Churn?

Nerd's Eye View

JULY 18, 2022

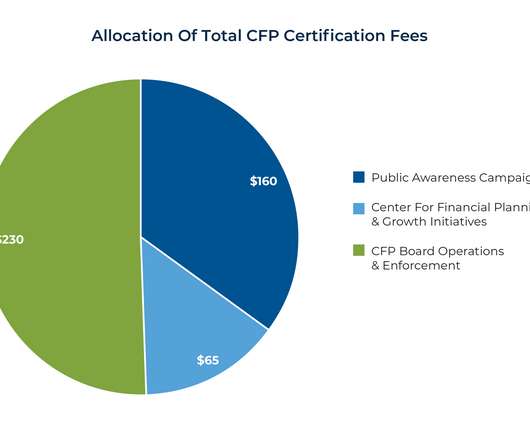

To meet this challenge, CFP Board’s Center For Financial Planning has engaged in fundraising for several years to fuel campaigns that have focused on building the advisor workforce of the future.

Let's personalize your content