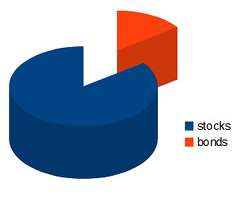

Asset Allocation

MainStreet Financial Planning

AUGUST 16, 2022

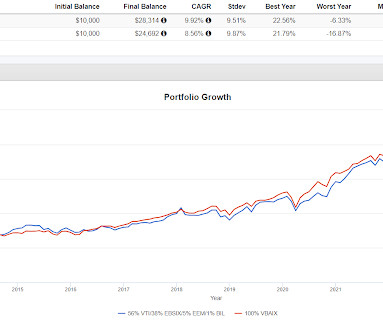

There are many steps in building an investment portfolio, in this article, I’ll discuss how asset allocation and risk tolerance are important considerations when investing. In simple terms, asset allocation is the mix of all the different types of investments you have in your portfolio. Some examples include U.S.

Let's personalize your content