Monday links: asset allocation magic

Abnormal Returns

OCTOBER 30, 2023

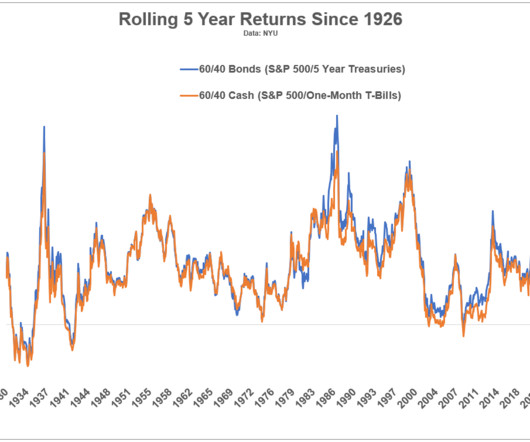

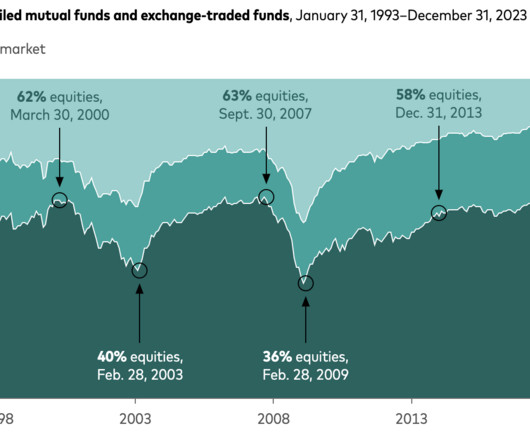

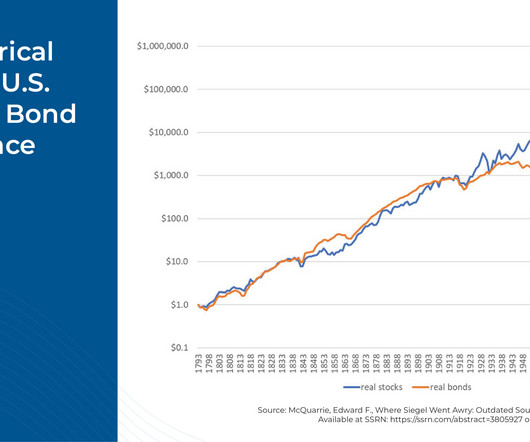

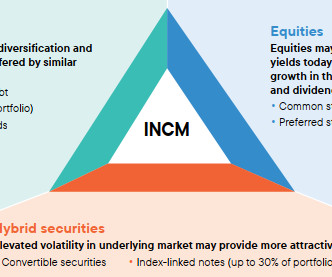

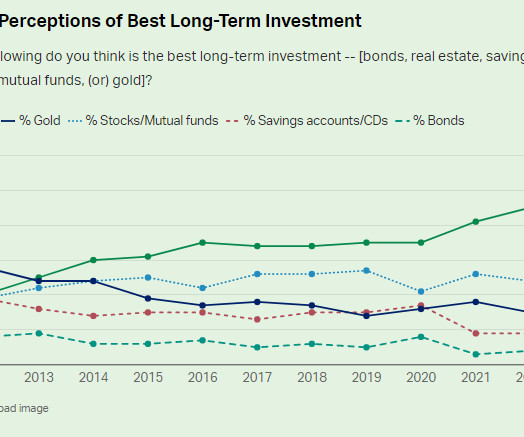

Strategy There's nothing magic about asset allocation. morningstar.com) Companies Google ($GOOGL) is investing $2 billion in AI player Anthropic. obliviousinvestor.com) Do stocks really become less risky over the long run? axios.com) Pharmaceutical companies are getting out to the consumer product business.

Let's personalize your content