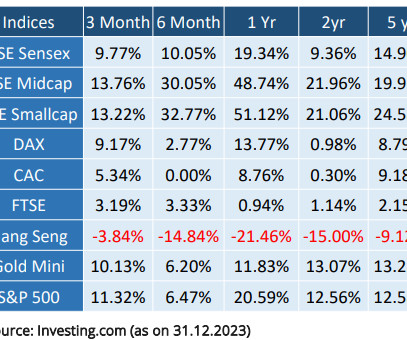

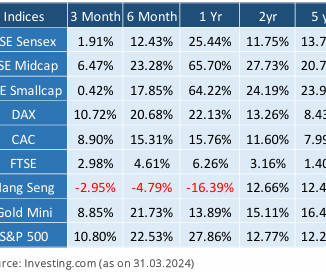

Financial Market Round-Up – Jan’24

Truemind Capital

JANUARY 16, 2024

Contrary to the expectation of an economic slowdown in 2023, the year turned out to be full of surprises, mostly positive ones. Some of the fund managers continued discouraging flows in Mid & Small Cap stocks by either sounding cautious, dropping coverage, or stopping the inflows owing to frothy valuations in the space.

Let's personalize your content