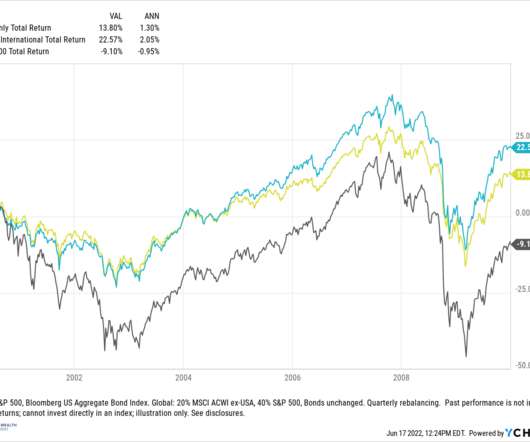

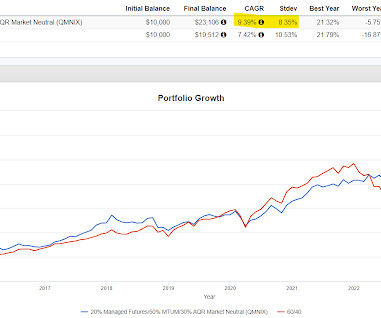

Tuesday links: the case for diversification

Abnormal Returns

JUNE 27, 2023

Strategy High uncertainty decisions, like investing, are by definition difficult. behaviouralinvestment.com) Do commodities have a role to play in a long-term, strategic asset allocation? bloomberg.com) SpaceX's valuation keeps rising, due in part to Starlink's success. Prices are now rising again.

Let's personalize your content