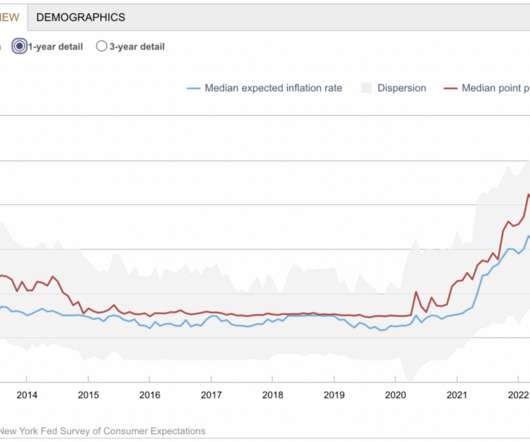

Inflation Expectations: A Dubious Survey

The Big Picture

SEPTEMBER 21, 2022

Consider : Questioning investors as to their risk tolerance does not typically result in an accurate description of their true tolerance for drawdowns and lower returns; instead, we get a number highly dependent upon the performance of equity markets over the prior three to six months.

Let's personalize your content